Wondering what is my car’s equity? Your car’s equity is the difference between what your car is currently worth and how much you still owe on your car loan. So, if your car is worth $15,000 and you owe $10,000, you have $5,000 in equity. This guide will walk you through how to find out the equity in your car, so you can make informed decisions about selling, trading, or refinancing.

Having positive equity in your car is a great financial position to be in. It means you own more of your vehicle than the loan company does. This can open up several possibilities, like selling your car for a profit, using it as a down payment on a new vehicle, or even accessing cash through a car equity loan or cash-out refinance. But before you can leverage that equity, you need to know how much you actually have. This involves two key pieces of information: your car’s current market value and your auto loan payoff amount.

Image Source: canadianautobrokers.ca

Deciphering Your Car’s Market Value

The first step in figuring out your car’s equity is to get an accurate car value estimation. This isn’t just about what you think your car is worth; it’s about what the market is willing to pay for it today. Several factors influence your car’s value, including its make, model, year, mileage, overall condition (both mechanical and cosmetic), trim level, and any optional features it has. The demand for that specific vehicle in your local market also plays a significant role.

Where to Get a Car Value Estimation

There are several reliable sources you can use to determine how much is my car worth:

- Online Valuation Tools: Websites like Kelley Blue Book (KBB), Edmunds, and NADA Guides are excellent resources. They provide car value estimation based on a vast database of sales transactions and market trends. You’ll typically input your car’s VIN (Vehicle Identification Number), mileage, condition, and features.

- Dealership Appraisals: Visiting local dealerships, especially those that sell your car’s make, can provide a quick car trade-in value. While this is often an estimate for trade-in purposes, it gives you a real-world idea of what dealers might offer.

- Private Sale Listings: Check online marketplaces like Craigslist, Facebook Marketplace, and AutoTrader to see what similar cars are listed for in your area. This gives you an idea of the private party sale price, which is usually higher than a trade-in value.

Using Online Valuation Tools Effectively

When using online tools, be honest and thorough in your input. The difference between “good” and “very good” condition can significantly impact the estimated value. Consider the following when using these tools:

- Condition: Be realistic about any dings, scratches, interior wear, or mechanical issues.

- Mileage: Higher mileage generally lowers a car’s value.

- Features: Note all optional packages and features, as these can add value.

- Location: Some tools allow you to adjust for regional market differences.

Determining Your Auto Loan Payoff Amount

The second crucial piece of information for your car equity calculation is your auto loan payoff. This is the exact amount you currently owe to the lender for your car loan. It’s not simply the remaining balance you see on your monthly statement. The payoff amount includes the principal balance, any accrued interest up to the payoff date, and potentially any late fees or other charges.

How to Determine Your Auto Loan Payoff

To find your payoff amount for car, you need to contact your lender directly. Here’s how:

- Call Your Lender: This is the most straightforward method. Dial the customer service number on your car loan statement or your lender’s website. Ask for your auto loan payoff statement or quote. They will typically ask for your account number and some personal verification details.

- Online Account Access: Many lenders allow you to log in to your online account. Look for an option to view your loan details or request a payoff quote. This is often the quickest way to get the information.

- Request in Writing: While less common, you can also request a payoff quote in writing, though this will take longer to receive.

What to Expect When Requesting a Payoff Quote

When you contact your lender, they will provide you with a payoff quote that is usually valid for a specific period, typically 10-15 days. This quote will break down the amount:

- Principal Balance: The remaining amount borrowed.

- Accrued Interest: Interest that has accumulated since your last payment.

- Any Fees: This could include per diem interest (interest that accrues daily), late fees, or other charges.

It’s important to get an official payoff quote, not just your current outstanding balance, as the latter might not reflect interest accrued since your last payment.

Calculating Your Car Equity

Once you have both your car’s estimated market value and your auto loan payoff amount, you can perform your car equity calculation.

Car Equity = Car’s Estimated Market Value – Auto Loan Payoff Amount

Let’s break this down with an example:

- Car’s Estimated Market Value (from KBB/Edmunds): $18,000

- Auto Loan Payoff Amount (from your lender): $12,000

Car Equity = $18,000 – $12,000 = $6,000

In this scenario, you have $6,000 in equity in vehicle.

Positive Equity vs. Negative Equity

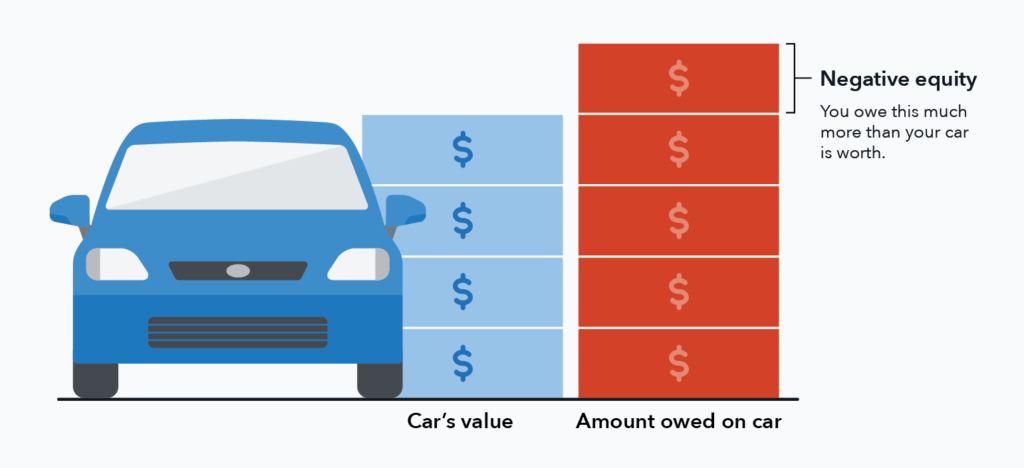

It’s important to distinguish between positive and negative equity:

- Positive Equity: When your car’s market value is greater than your loan payoff amount. This is the ideal situation, giving you financial flexibility.

- Negative Equity (Upside Down): When your car’s market value is less than your loan payoff amount. For instance, if your car is worth $10,000 but you owe $13,000, you have negative equity of $3,000. You would need to calculate negative equity car to understand how much extra you’d need to pay to clear the loan.

Example of Negative Equity Calculation

- Car’s Estimated Market Value: $10,000

- Auto Loan Payoff Amount: $13,000

Car Equity = $10,000 – $13,000 = -$3,000

In this case, you have $3,000 in negative equity. If you were to sell the car for its market value, you would still owe the lender $3,000.

Factors Influencing Your Car’s Value

Several factors can cause your car’s value to fluctuate significantly. Being aware of these will help you get a more accurate car value estimation.

Mileage

This is one of the biggest drivers of depreciation. Cars with lower mileage are generally worth more than those with higher mileage. An average car gains about 12,000-15,000 miles per year. Exceeding this can lead to a sharper drop in value.

Condition

The overall condition of your car is paramount. This includes:

- Exterior: Dents, scratches, rust, paint condition, tire wear.

- Interior: Upholstery condition, cleanliness, functionality of electronics, absence of odors.

- Mechanical: Engine health, transmission performance, brake condition, suspension.

A well-maintained car will fetch a higher price than one that shows signs of neglect. Regular maintenance, timely repairs, and careful driving habits all contribute to preserving your car’s value.

Maintenance Records

Having documented proof of regular maintenance and repairs can significantly boost your car’s perceived value. Buyers are more confident purchasing a vehicle with a history of proper care. Keep all your service records organized.

Features and Options

Higher trim levels and desirable options like a sunroof, premium sound system, navigation, leather seats, or advanced safety features can increase your car’s market value.

Accident History

Any reported accidents, especially severe ones, will likely decrease your car’s value, even if it has been repaired.

Market Demand

The popularity of your car’s make and model, as well as the overall demand for used cars in your region, will influence its price. Some vehicles hold their value better than others. For example, fuel-efficient cars might be in higher demand in areas with high gas prices.

When to Check Your Car’s Equity

There are several common scenarios where knowing your equity in vehicle is essential:

Selling Your Car Privately

If you have positive equity, selling your car privately often yields a higher price than trading it in. Your equity is the cash you would pocket after paying off the loan.

Trading In Your Car

When trading your car in at a dealership, your equity directly impacts how much money you save on your next purchase. Positive equity reduces the amount you need to finance for your new car. Negative equity means you might have to roll the outstanding balance into your new loan, increasing your overall debt.

Buying a New Car

If you have significant equity, you can use it as a down payment on a new vehicle, reducing your monthly payments and the total interest paid over the life of the loan.

Refinancing Your Auto Loan

If your credit score has improved or interest rates have dropped, you might consider refinancing your car loan. Positive equity can make it easier to get approved for a refinance and potentially secure a lower interest rate.

Getting a Car Equity Loan or Cash-Out Refinance

If you have substantial positive equity, you might be able to borrow against it. A car equity loan or a cash-out refinance allows you to access the cash tied up in your car’s equity for other needs, such as home renovations, debt consolidation, or unexpected expenses.

Common Pitfalls to Avoid

When assessing your car’s equity, be aware of these common mistakes:

- Overestimating Your Car’s Value: Relying on inflated asking prices or personal sentiment rather than market data.

- Forgetting About Fees: Not accounting for potential fees when calculating your loan payoff amount.

- Ignoring Depreciation: Not realizing how quickly cars lose value, especially in the first few years.

- Not Checking Loan Terms: Not knowing if there are any prepayment penalties on your auto loan.

Tools and Resources for Car Equity Calculation

To help you with your car equity calculation, consider using the following resources:

| Resource | Primary Function | Key Features |

|---|---|---|

| Kelley Blue Book (KBB) | Car value estimation (trade-in, private party, retail) | Comprehensive data, condition adjustments, feature input. |

| Edmunds | Car value estimation, reviews, comparisons | Similar to KBB, often provides dealer quotes. |

| NADA Guides | Vehicle valuation for various industries | Often used by dealerships and financial institutions; can provide retail values. |

| Your Lender’s Website | Loan payoff quotes, account management | Official, up-to-date figures for your specific loan. |

| Online Marketplaces | Real-world pricing for private sales | Craigslist, Facebook Marketplace, AutoTrader – shows what people are asking. |

Step-by-Step Guide Recap

- Find your car’s estimated market value: Use online tools and compare results.

- Contact your lender for your auto loan payoff: Get an official quote.

- Subtract the payoff amount from the market value: This gives you your equity.

- Identify if you have positive or negative equity: This determines your options.

Frequently Asked Questions (FAQ)

Q1: How often should I check my car’s equity?

It’s a good idea to check your car’s equity periodically, especially if you’re considering selling or trading it in soon. Market values can fluctuate, and your loan balance decreases with each payment. A good time to check is annually, or whenever you’re planning a major financial decision involving your car.

Q2: Can I get a loan using my car’s equity?

Yes, if you have positive equity, you may be able to get a car equity loan or a cash-out refinance. These loans allow you to borrow money against the value of your car. However, be cautious, as this puts your car at risk if you cannot repay the loan.

Q3: What’s the difference between car equity and car value?

Car value is simply what your car is worth on the market. Car equity is the portion of that value that you own outright, after deducting what you owe on the car loan.

Q4: How do I calculate negative equity car situations?

To calculate negative equity car situations, you subtract your car’s estimated market value from your total auto loan payoff. If the result is a negative number, that’s your negative equity. For example, if your car is worth $15,000 and you owe $18,000, your negative equity is $3,000 ($15,000 – $18,000 = -$3,000).

Q5: What is a car trade-in value?

A car trade-in value is the amount a dealership is willing to offer you for your current car when you are buying a new or used car from them. This amount is typically lower than the private party sale value because the dealership needs to make a profit by reselling the car.

Q6: How do I find my auto loan payoff?

To find your auto loan payoff, you must contact your lender directly. Call their customer service, check your online account, or request a written statement. The payoff amount includes the principal balance, accrued interest, and any applicable fees.

By following these steps and utilizing the available resources, you can accurately determine the equity in vehicle and make informed decisions about your automotive finances. Knowing your car’s equity empowers you with knowledge, whether you’re looking to sell, upgrade, or leverage that value for other financial needs.