Yes, you can trade in a financed car for another car, even if you still owe money on the original loan. This process is common, and understanding how it works can help you make informed decisions about your next vehicle. This guide will break down the possibilities, from positive equity to navigating negative equity, and explore your options when you have a car loan trade-in.

Image Source: content-images.carmax.com

Fathoming Your Car Loan Trade-In Situation

When you trade in a financed car, the dealership or buyer will pay off the remaining balance of your car loan. The amount they pay is determined by the car’s trade-in value. This value is compared to your outstanding loan balance to determine if you have equity in a financed car.

Positive Equity Car Trade-In: The Ideal Scenario

Having positive equity in a financed car means the trade-in value of your current vehicle is higher than the amount you still owe on the loan. This is the best-case scenario.

How it works:

- Dealer Pays Off Loan: The dealer will use the trade-in value to pay off your existing loan.

- Surplus Goes Towards New Car: Any remaining amount from the trade-in value after the loan is paid off is applied as a down payment on your new car.

- Lower Monthly Payments: This surplus can significantly reduce the amount you need to finance for your new vehicle, potentially leading to lower monthly payments or a shorter loan term.

Example:

| Item | Amount |

|---|---|

| Trade-in Value of Old Car | $15,000 |

| Remaining Loan Balance | $12,000 |

| Positive Equity | $3,000 |

In this case, the dealer pays off the $12,000 loan, and you have $3,000 to use as a down payment on your next car.

Negative Equity Car Trade-In: The Challenge

A negative equity car trade-in occurs when you owe more on your car loan than its current market value. This is often referred to as being “upside down” on your loan.

How it works:

- Shortfall to Cover: The trade-in value won’t cover the full remaining loan balance.

- Paying the Difference: You will need to cover the difference between the trade-in value and the loan payoff amount.

- Options for the Shortfall:

- Pay it Outright: You can pay the shortfall in cash to the dealership.

- Roll it into the New Loan: The dealership may allow you to roll the negative equity into the loan for your new car. This increases the total amount you finance, leading to higher monthly payments and potentially more interest paid over the life of the loan.

Example:

| Item | Amount |

|---|---|

| Trade-in Value of Old Car | $10,000 |

| Remaining Loan Balance | $14,000 |

| Negative Equity | $4,000 |

In this scenario, the dealer pays off the $14,000 loan using the $10,000 trade-in value. You still owe $4,000. You’d need to pay this $4,000 in cash or add it to your new car loan.

Your Options for Trading in a Financed Car

Whether you have positive or negative equity, there are several avenues you can explore when trading in a car with a loan.

Option 1: The Car Dealer Trade-In Financed

This is the most common and straightforward method. When you buy a new car with an existing loan, most dealerships will happily handle the trade-in process for you.

Steps Involved:

- Get Your Loan Information: Before visiting a dealership, contact your lender to get an accurate payoff quote for your current car loan. This quote is typically valid for a specific period (e.g., 10 days).

- Research Your Car’s Value: Use online resources like Kelley Blue Book (KBB), Edmunds, or NADA Guides to get an estimate of your car’s market value. Consider condition, mileage, and features.

- Visit Dealerships: Shop for your new car. When you’re ready to discuss trade-in, let the dealer know you have a financed vehicle.

- Dealer Assessment: The dealership will assess your car’s condition and mileage to determine its trade-in value.

- Negotiation: Negotiate the price of your new car and the trade-in value of your current one.

- Loan Payoff: If you agree on a price, the dealership will use the trade-in value to pay off your existing loan.

- Handle Equity:

- Positive Equity: The dealership will credit the surplus to your new car purchase.

- Negative Equity: You’ll need to address the difference as discussed earlier.

- New Financing: You’ll then arrange financing for the remaining balance of your new car, factoring in any trade-in adjustments.

Pros:

- Convenience: The dealership handles all the paperwork and communication with your lender.

- One-Stop Shop: You can drive away in a new car the same day.

- Potential for Good Deals: Dealers may offer competitive trade-in values to secure a new car sale.

Cons:

- Lower Trade-In Value: Dealerships typically offer less than what you might get selling a financed car privately.

- Pressure to Buy: You might feel pressured to buy a car from the dealership where you trade in.

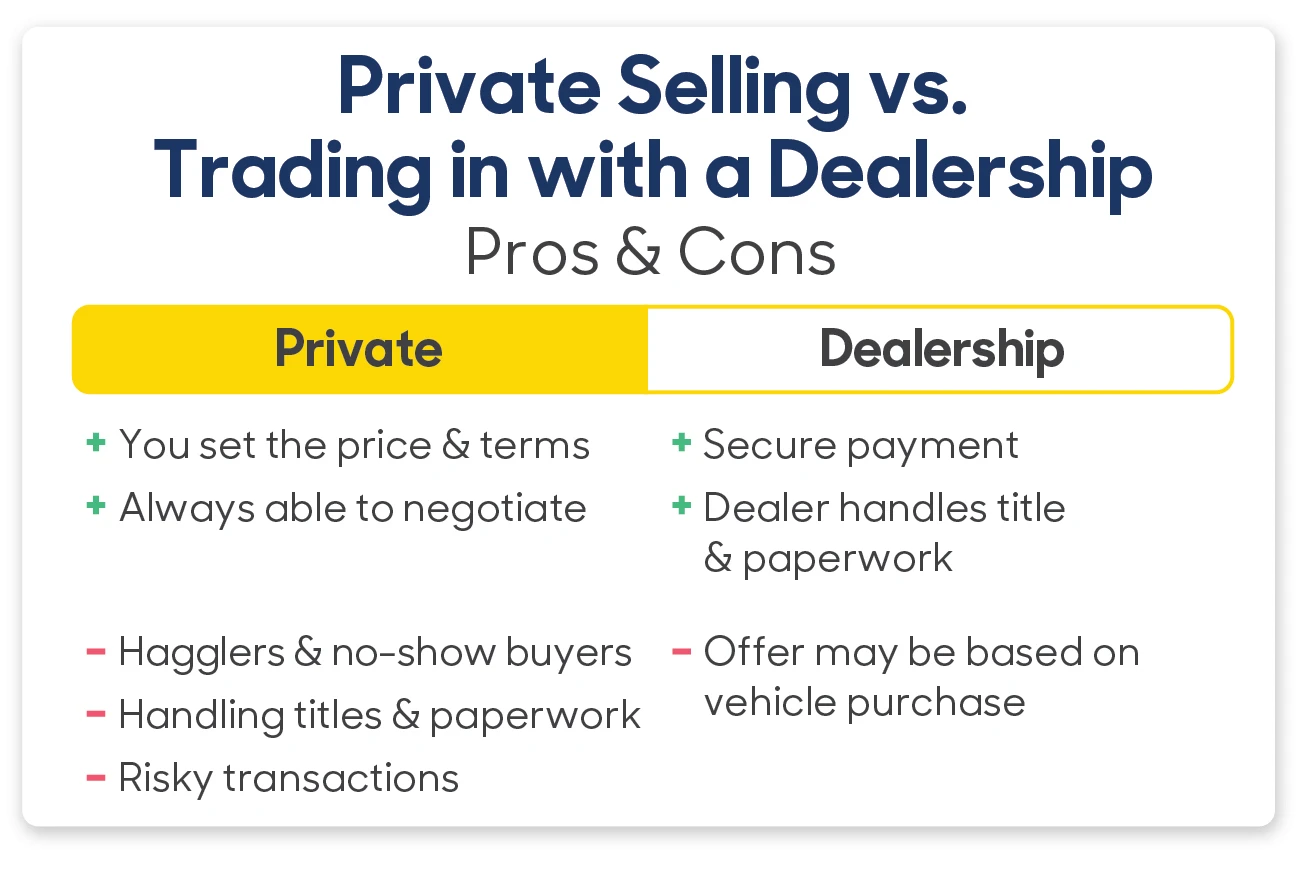

Option 2: Selling a Financed Car Privately

Selling a financed car yourself can often yield a higher price than trading it in at a dealership, especially if you have positive equity.

Steps Involved:

- Get Payoff Quote: Obtain your loan payoff quote from your lender.

- Determine Market Value: Research your car’s private party sale value.

- Advertise: Create an ad with details, photos, and clear pricing.

- Screen Buyers: Be cautious and screen potential buyers.

- Arrange Payment and Loan Payoff: This is the most critical step.

- If you have positive equity: A buyer can pay you the agreed-upon price. You then use a portion of that money to pay off your loan. Once the loan is cleared, you’ll get the lien release from your lender and can transfer the title to the buyer. You keep the profit.

- If you have negative equity: This is more complex. The buyer would need to pay enough to cover your loan payoff plus any additional amount you owe. Alternatively, you might need to pay off the difference to your lender before you can sell the car and transfer the title, or the buyer might have to handle the loan payoff directly with your lender, which can be complicated.

- Title Transfer: Once the loan is paid off, your lender will release the title. You then sign it over to the buyer.

Pros:

- Higher Potential Price: You can often get more money by selling directly to another individual.

- More Control: You set the price and choose your buyer.

Cons:

- More Effort: It requires more time and effort to advertise, show the car, and handle paperwork.

- Payment Risks: Dealing with cash payments or ensuring the buyer’s financing is secure can be risky.

- Complexity with Loans: The process of transferring title and paying off the loan needs careful coordination.

Option 3: Car Loan Refinance and Trade-In

If you’re struggling with your current car loan payments and are considering a trade-in, car loan refinance and trade-in might be an option. However, this is generally less about trading in and more about managing your current loan before a potential future trade-in.

How it applies to trade-ins:

- Refinancing to Lower Payments: If your current car loan has high interest rates or unmanageable payments, refinancing might lower your monthly obligations. This can improve your financial standing, potentially making it easier to qualify for a new loan or manage negative equity if you decide to trade in later.

- Refinancing with Equity: In some cases, if you have substantial equity in a financed car, you might be able to refinance your existing loan for a larger amount than you owe. This cash-out refinance could provide funds to cover the negative equity on a future trade-in or be used for other purposes. However, this is less common for cars and more prevalent for homes.

Important Note: Refinancing your current loan while also trading in the car usually means the dealership is handling the payoff of the old loan, and you’re securing a new loan for the new car. This isn’t “refinancing and trading in” in the sense of altering your current loan terms before the trade. It’s simply managing your existing car financing.

Navigating Negative Equity Car Trade-In Situations

Dealing with a negative equity car trade-in requires careful planning and a clear understanding of your financial obligations.

Strategies for Negative Equity:

- Save for a Larger Down Payment: Before you trade in, try to save enough cash to cover the difference between your car’s value and your loan payoff. This will prevent you from rolling negative equity into a new loan.

- Explore Different Dealerships: Some dealerships might be more willing to work with negative equity situations than others. Shop around to compare offers.

- Consider a Cheaper Car: Opting for a less expensive vehicle can make it easier to manage negative equity. You might be able to find a car whose price, even with the negative equity added, is still within your budget.

- Keep the Car Longer: If possible, continue driving your current car. As you make more payments, the loan balance decreases, and the car’s value might eventually catch up. This could lead to positive equity down the line.

- Wait for a Better Market: Sometimes, market conditions for used cars improve, increasing your car’s value. Waiting can be beneficial if you’re not in a rush.

The Impact of Rolling Negative Equity:

| Factor | Impact |

|---|---|

| Monthly Payment | Increases because the total loan amount is higher. |

| Loan Term | May need to extend the loan term to keep payments manageable. |

| Total Interest | You’ll pay more interest over the life of the loan. |

| Future Trade-In | You could be in a negative equity situation again with the new car. |

Rolling negative equity is often a temporary fix that can lead to greater financial strain in the long run.

When to Consider Trading in a Financed Car

Several situations might prompt you to consider a car loan trade-in:

- Your Needs Have Changed: You need a larger vehicle for a growing family, a smaller car for better fuel efficiency, or a truck for work.

- High Repair Costs: Your current car is becoming unreliable and costing too much in repairs.

- Desire for a Newer Vehicle: You want the latest technology, safety features, or simply a newer model.

- Job Change or Relocation: Your commute has changed, or you need a vehicle better suited to your new lifestyle.

- Leveraging Positive Equity: If you have substantial equity in a financed car, trading it in can significantly reduce the cost of your next vehicle.

Important Considerations Before You Trade In

- Know Your Numbers: Always have your loan payoff amount and your car’s estimated value before you start shopping.

- Get Pre-Approved for Financing: This gives you leverage and helps you understand your budget for a new car.

- Be Realistic About Trade-In Value: Understand that dealerships aim to make a profit.

- Read All Paperwork Carefully: Ensure all figures, especially concerning your trade-in and the new loan, are correct before signing.

- Don’t Be Afraid to Walk Away: If the deal doesn’t feel right or the numbers don’t add up, be prepared to walk away and explore other options.

Frequently Asked Questions (FAQ)

Q1: Can I trade in a financed car if I have bad credit?

A: Yes, you can. However, having bad credit might mean higher interest rates on your new car loan, and you may have less room to negotiate negative equity into the new loan. It’s advisable to improve your credit score if possible before trading in.

Q2: What happens if my car is totaled in an accident and I still owe money?

A: If your car is totaled, your auto insurance should pay out the actual cash value of the vehicle. If this amount is less than your remaining loan balance, you’ll still owe the difference to the lender. This is where gap insurance can be crucial, as it covers this exact shortfall.

Q3: Does trading in a financed car affect my credit score?

A: The act of trading in a financed car itself doesn’t directly hurt your credit. However, paying off your old loan and taking out a new loan will involve credit inquiries. If you roll negative equity into a new loan, the higher loan amount could potentially impact your debt-to-income ratio, which lenders consider.

Q4: How long does it take to pay off a financed car when trading it in?

A: The dealership typically handles the payoff within a few days of the transaction. You’ll receive confirmation from your lender once the loan is officially closed out.

Q5: What if the dealership offers less for my trade-in than my loan payoff?

A: This means you have negative equity. As discussed, you’ll need to pay the difference, either in cash or by rolling it into your new car loan.

Q6: Is it better to trade in or sell privately when I have a financed car?

A: This depends on your equity. If you have positive equity, selling privately might get you more money. If you have negative equity and want the most convenience, a car dealer trade-in financed is usually easier, though you’ll likely get less for your car than selling privately.

Q7: Can I trade in a financed car to another dealership?

A: Absolutely. You can trade your financed car at any dealership, regardless of where you originally purchased or financed it.

In conclusion, trading in a financed car is a common practice with various strategies available to suit your financial situation. By thoroughly researching your options, knowing your numbers, and being prepared, you can successfully navigate the process and drive away in a new vehicle.