Image Source: www.therollinsfirm.com

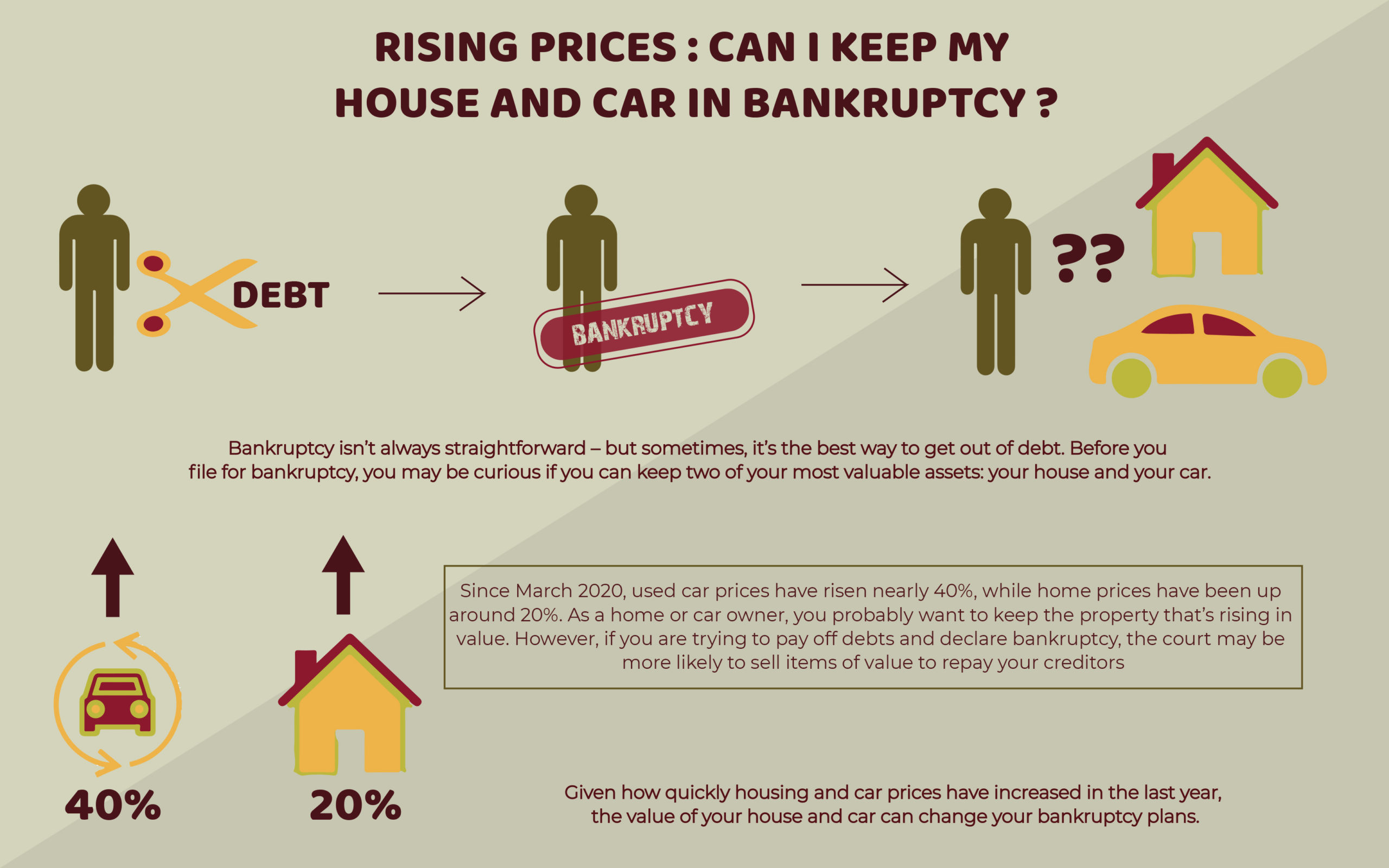

Can You Claim Bankruptcy And Keep Your House And Car?

Yes, it is often possible to claim bankruptcy and keep your house and car, but it depends on various factors, including the type of bankruptcy filed, your state’s laws, the amount of equity you have in these assets, and whether you can afford to continue making payments.

Navigating the complexities of bankruptcy can feel like trying to find your way through a maze, especially when you’re worried about losing essential belongings like your home and vehicle. The good news is that bankruptcy laws are designed to offer a fresh start while also providing mechanisms to protect certain assets. This means that filing for bankruptcy doesn’t automatically mean you’ll lose your house or car. Instead, it opens up possibilities to negotiate with creditors and, in many cases, keep these vital possessions.

The ability to keep your house and car hinges on specific legal provisions known as exemptions, and the type of bankruptcy you choose to file. Two primary chapters of the U.S. Bankruptcy Code are most relevant for individuals: Chapter 7 and Chapter 13. Each offers different pathways to debt relief and asset protection.

Deciphering Bankruptcy Chapters: Chapter 7 vs. Chapter 13

When considering bankruptcy, it’s crucial to grasp the fundamental differences between Chapter 7 and Chapter 13. These chapters serve different purposes and have distinct rules regarding what you can keep.

Chapter 7: The Quick Route to Debt Relief

Chapter 7 is often referred to as liquidation bankruptcy. In this process, a court-appointed trustee sells off your non-exempt assets to pay your creditors. The primary goal of Chapter 7 is to discharge most unsecured debts, such as credit card debt and medical bills, quickly.

- How it works: You file a petition with the bankruptcy court, listing all your debts, assets, income, and expenses. A trustee is assigned to review your case and may sell any assets that are not protected by exemptions. The proceeds from the sale are then distributed to your creditors.

- Keeping your house and car in Chapter 7: The key to keeping your property in Chapter 7 lies in the concept of exemptions. Each state, and the federal government, provides a list of assets that are shielded from creditors during bankruptcy. These exemptions can cover a certain amount of equity in your home, car, personal belongings, and retirement funds.

- Homestead Exemption: This allows you to protect a certain amount of equity in your primary residence. The amount varies significantly by state.

- Motor Vehicle Exemption: Similarly, there’s an exemption for your car, protecting a specific value of equity.

- Other Exemptions: States also have exemptions for household goods, tools of the trade, retirement accounts, and more.

Chapter 13: The Reorganization Plan

Chapter 13 is often called wage earner’s bankruptcy or reorganization bankruptcy. It’s designed for individuals who have a regular income and want to catch up on missed payments for secured debts like mortgages and car loans, while also managing other debts.

- How it works: Instead of selling assets, you propose a repayment plan to the court. This plan typically lasts three to five years, during which you make regular payments to a trustee. The trustee then distributes these payments to your creditors according to the plan.

- Keeping your house and car in Chapter 13: Chapter 13 is generally more effective for keeping secured assets when you have more equity than exemptions allow or if you are behind on payments.

- Catching Up on Payments: You can use your repayment plan to pay off past-due mortgage or car payments over time, bringing you current and allowing you to keep the property.

- Lien Stripping: In certain situations, Chapter 13 allows for lien stripping. This is a powerful tool that can remove a second mortgage or a junior lien on your home if the debt owed on that lien exceeds the value of your property. Essentially, the stripped lien can be converted into an unsecured debt, which may be discharged in bankruptcy or paid off with pennies on the dollar in your repayment plan. This is not typically available in Chapter 7.

Protecting Your Possessions: The Role of Exemptions

Exemptions are the bedrock of asset protection in bankruptcy. Without them, bankruptcy trustees would have the authority to sell all assets to satisfy creditors. Fortunately, both federal and state governments recognize that individuals need certain essential items to maintain their lives and livelihoods.

Federal vs. State Exemptions

When you file for bankruptcy, you generally have a choice between using the federal bankruptcy exemptions or your state’s exemptions. Some states allow you to use a mix of both, while others require you to choose one set exclusively.

- Federal Exemptions: These are a set of standard exemptions provided by federal law. They include generous homestead exemptions in some states, but their applicability can be limited if your state has opted out and established its own exemption scheme.

- State Exemptions: Each state has its own unique set of exemptions, which can vary widely. Some states offer very robust protections, allowing you to keep a significant amount of home equity or a higher value car. Other states have more modest exemptions. It’s vital to research the specific exemptions available in the state where you have lived for the majority of the past two years.

Specific Exemptions for Houses and Cars

Let’s delve deeper into how exemptions apply to your most significant assets:

-

Your Home (Homestead Exemption):

- How it works: The homestead exemption protects a certain dollar amount of equity in your primary residence. Equity is the difference between the market value of your home and the amount you owe on your mortgage.

- Example: If your state’s homestead exemption is $50,000 and you owe $150,000 on your mortgage for a home valued at $200,000, you have $50,000 in equity. In this scenario, you would be able to keep your home in Chapter 7 because your equity is fully covered by the exemption. If your equity exceeded the exemption amount, the trustee might sell the home, pay off your mortgage, give you the exempt amount, and use the remainder to pay creditors.

- Factors to consider: Some states have unlimited homestead exemptions, while others are capped at a relatively low amount. The length of time you’ve owned the home can also affect which exemptions you can use in some states.

-

Your Car (Motor Vehicle Exemption):

- How it works: Similar to the homestead exemption, there’s an exemption for your vehicle that protects a certain amount of its value (equity).

- Example: If you owe $15,000 on a car valued at $20,000, you have $5,000 in equity. If your state’s vehicle exemption is $5,000 or more, you can keep your car in Chapter 7. If the equity is higher than the exemption, a trustee might sell it, give you the exempt amount, and use the rest for creditors.

- Keeping a car with a loan: If you have a car loan, the lender has a lien on your vehicle. To keep the car in Chapter 7, you typically need to do one of two things:

- Reaffirmation Agreement: You can sign a reaffirmation agreement, which is a legal contract where you agree to continue making payments on the loan and are responsible for the full amount owed, even if the car’s value drops below what you owe. This usually requires the court’s approval and a demonstration that you can afford the payments.

- Redemption: You can pay the lender the current market value of the car in a lump sum. This is often difficult to do without cash.

Strategies for Keeping Your House and Car

Beyond relying solely on exemptions, there are specific strategies and actions you can take to maximize your chances of retaining your home and vehicle.

The Power of Reaffirmation Agreements

A reaffirmation agreement is a crucial tool for individuals filing Chapter 7 who want to keep their secured debts, like car loans or mortgages.

- What it is: It’s a voluntary agreement between you and your creditor to continue paying a debt after bankruptcy. By signing it, you agree to remain legally obligated to pay the debt in full, and the creditor agrees to let you keep the collateral (your house or car).

- When it’s used: This is common when you are current on your payments and the value of the asset is less than the debt owed, or when your equity is covered by exemptions.

- Court Approval: For a reaffirmation agreement to be valid, it generally needs to be approved by the bankruptcy court. The court wants to ensure that you can afford the payments and that reaffirming the debt is in your best interest. You will likely need to provide proof of income and demonstrate that the payments won’t cause undue hardship.

Using Chapter 13 to Catch Up

As mentioned earlier, Chapter 13 offers a structured way to get back on track with your mortgage or car payments.

- Payment Plans: Your Chapter 13 repayment plan can include catching up on any missed payments over the life of the plan (three to five years). This means you pay your regular monthly payment plus a portion of the arrears each month.

- Keeping Secured Assets: This is particularly beneficial if you have fallen behind on payments and are facing foreclosure or repossession. By filing Chapter 13, you get an automatic stay that stops these actions, giving you time to reorganize your finances and catch up.

Lien Stripping in Chapter 13

Lien stripping is a powerful tactic available exclusively in Chapter 13 bankruptcy.

- Second Mortgages: If you have a second mortgage or a home equity line of credit (HELOC) and the total amount owed on your first mortgage plus the second mortgage is more than the value of your home, you may be able to “strip off” the second lien.

- How it works: The second lien is treated as an unsecured debt. It might be paid off entirely through your Chapter 13 plan or discharged if you don’t have enough disposable income to pay it. This can significantly reduce your overall debt burden.

- Car Loans in Chapter 13: While not always called lien stripping, you can also use Chapter 13 to adjust car loans under certain circumstances, especially if the loan is “underwater” (you owe more than the car is worth). This is known as a “cramdown.”

Considerations for Keeping Your Car

Keeping your car is often a priority for maintaining your ability to work and manage daily life. Here’s a breakdown of how it works:

-

Car Value and Loan Balance: The key factor is the relationship between the car’s market value and the amount you owe on the loan.

- Equity Less Than Exemption: If your equity is less than your state’s vehicle exemption in Chapter 7, you can typically keep the car without any issues.

- Equity More Than Exemption: If your equity exceeds the exemption limit in Chapter 7, you’ll need to either reaffirm the debt or consider redemption.

- Behind on Payments: If you are behind on car payments, Chapter 7 might not be enough to save the car unless you can quickly catch up or reaffirm. Chapter 13 is often the better choice here, as it allows you to pay off the arrears over time.

-

Your Ability to Pay: Regardless of the bankruptcy chapter, creditors will want assurance that you can make the ongoing payments for your car. Lenders often have income requirements that you’ll need to meet.

Considerations for Keeping Your House

Your home is likely your most significant asset and a major source of financial stress when considering bankruptcy.

- Home Equity and Exemptions: The amount of equity you have in your home is the primary determinant of whether you can keep it in Chapter 7. The homestead exemption is your shield. If your equity is below the exempt amount, you’re in a strong position to keep it.

- Mortgage Payments: In both Chapter 7 and Chapter 13, you must continue to make your mortgage payments to keep your house.

- In Chapter 7, if you want to keep the house and are current on payments, you might reaffirm the debt. If you’re behind, you may need to use Chapter 13 to catch up.

- In Chapter 13, you can propose a plan to pay off missed mortgage payments over time, thereby preventing foreclosure.

- Second Mortgages and HELOCs: As discussed, Chapter 13 provides the option of lien stripping for junior liens that are entirely unsecured, which can be a significant benefit for homeowners with multiple mortgages.

Asset Protection: Beyond Houses and Cars

While homes and cars are often the primary concerns, bankruptcy exemptions can also protect other valuable assets.

- Personal Property: This includes furniture, appliances, electronics, clothing, and jewelry. Most states provide exemptions for these items, ensuring you can maintain a basic standard of living.

- Tools of the Trade: If you rely on specific tools or equipment for your job, many exemptions protect these items so you can continue earning an income.

- Retirement Accounts: Generally, funds in qualified retirement accounts like 401(k)s, IRAs, and pensions are protected from creditors in bankruptcy.

- Wages and Bank Accounts: Exemptions can also apply to a certain amount of your wages and funds in your bank accounts.

When You Might Not Be Able to Keep Your House or Car

Despite the protections in place, there are situations where keeping your house or car might be challenging or impossible:

- Exceeding Exemption Limits: If the equity in your home or car significantly exceeds the available exemptions in Chapter 7, a trustee may sell the asset.

- Inability to Make Payments: If you cannot afford to make your regular mortgage or car payments, or if you cannot make the required payments under a Chapter 13 plan, you will likely lose the asset.

- Non-Dischargeable Debts: Some debts, like recent tax debts or student loans, are not dischargeable in bankruptcy. If you have substantial amounts of these, they can make it harder to manage secured debts and keep assets.

- Fraudulent Transfers: If you transferred assets to a friend or family member to hide them from the bankruptcy estate, the trustee can often recover those assets.

- Business Use Property: In Chapter 7, assets used primarily for business purposes might be treated differently and may not be protected by standard personal exemptions.

Frequently Asked Questions (FAQ)

-

Q: Can I keep my car if I have a car loan in Chapter 7?

A: Yes, you can often keep your car if you have a car loan in Chapter 7 by either entering into a reaffirmation agreement to continue payments or by redeeming the vehicle if you have the funds to pay its current market value. You must also be able to keep up with future payments and your equity must be covered by available exemptions. -

Q: What happens to my house if I have a lot of equity and file Chapter 7?

A: If the equity in your home exceeds your state’s homestead exemption, the bankruptcy trustee may sell your home. They would pay off your mortgage, give you the amount of your homestead exemption, and use the remaining proceeds to pay your creditors. -

Q: Is Chapter 13 better for keeping my car if I’m behind on payments?

A: Yes, Chapter 13 is generally a better option for keeping your car if you are behind on payments. Your repayment plan can allow you to catch up on the missed payments over three to five years, preventing repossession. -

Q: Can I get rid of a second mortgage in bankruptcy?

A: In Chapter 13 bankruptcy, you may be able to “strip” a second mortgage or HELOC if your home’s value is less than what you owe on the first mortgage. This effectively turns the second lien into an unsecured debt, which can be discharged or paid off at a reduced rate. This is not typically possible in Chapter 7. -

Q: Do I need to reaffirm my mortgage in Chapter 7?

A: If you are current on your mortgage payments and wish to keep your home, you generally have two options: reaffirm the debt through a reaffirmation agreement or “intentionally default” on the mortgage and then attempt to negotiate a loan modification with your lender after bankruptcy. Reaffirmation is more common and straightforward if you can afford the payments.

Seeking Professional Guidance

Bankruptcy law is intricate, and the specifics of exemptions, reaffirmation agreements, lien stripping, and asset protection can vary significantly based on your location and financial situation. Consulting with an experienced bankruptcy attorney is crucial. They can assess your assets, debts, and income to advise you on the best course of action to achieve your debt relief goals while preserving your essential belongings. They can also help you navigate the complexities of choosing between federal and state exemptions and ensure you meet all filing requirements.