Yes, it is often possible to file for bankruptcy and keep your car and house. The ability to retain these assets largely depends on the type of bankruptcy you file, the equity you have in them, and the laws in your state regarding exemptions.

Navigating the complexities of bankruptcy can feel overwhelming, especially when you’re worried about losing essential possessions like your car or home. The good news is that the U.S. bankruptcy system is designed to offer individuals a fresh start while providing mechanisms for asset protection. This means that with careful planning and the right guidance, you can often emerge from bankruptcy with your most valuable assets intact.

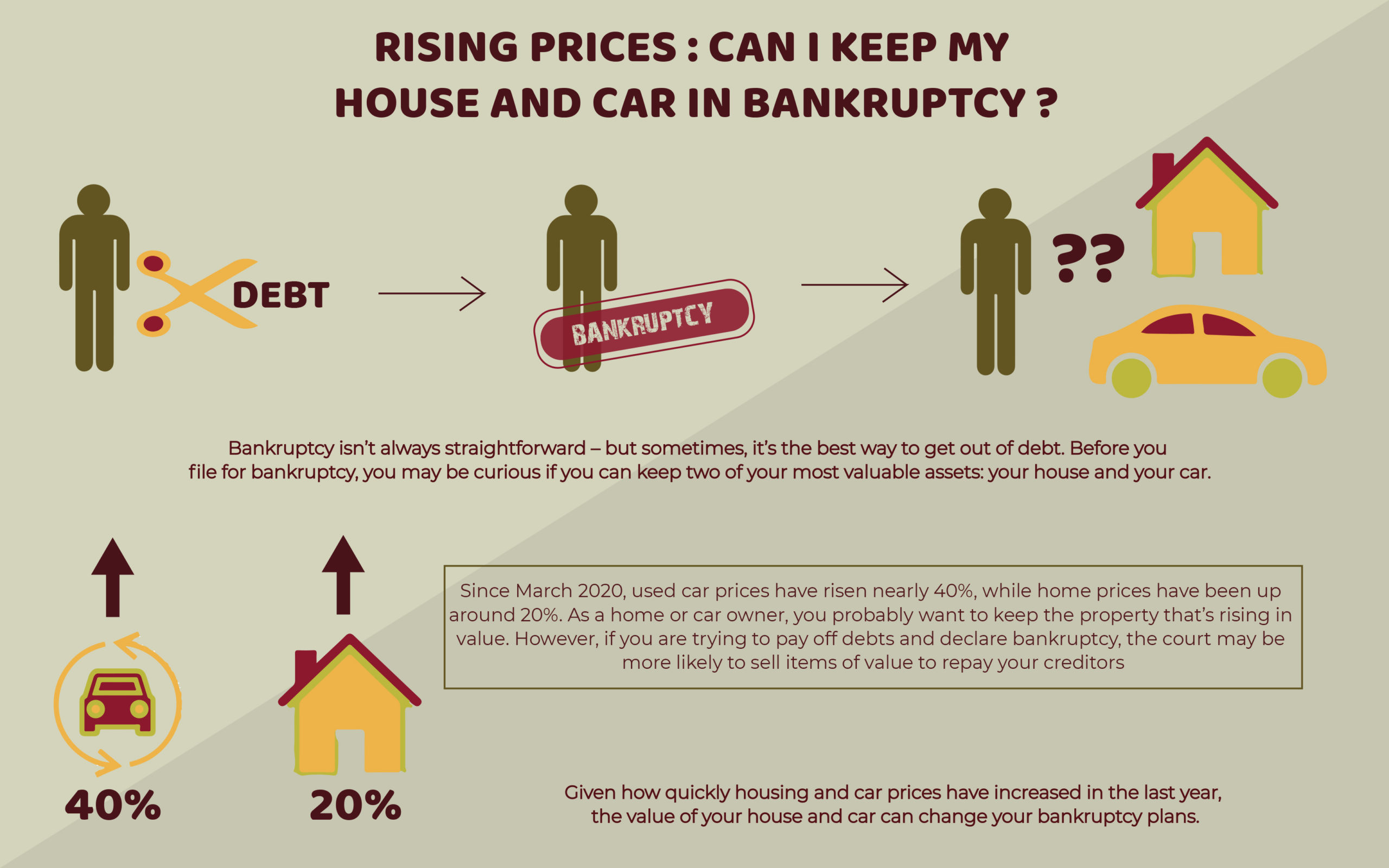

Image Source: www.therollinsfirm.com

Fathoming Your Bankruptcy Options

When people think about bankruptcy, they often imagine losing everything. However, this is a common misconception. The primary goals of bankruptcy are to provide debt relief and a fresh financial start. To achieve this, the law allows you to keep certain property, known as exempt property. The specific property you can keep varies depending on the chapter of bankruptcy you file and the state you live in.

Chapter 7: The Liquidation Pathway

Chapter 7 bankruptcy, often called liquidation, is the most common type of personal bankruptcy. In this process, a trustee is appointed to sell off your non-exempt assets to pay back your creditors. However, the majority of filers in Chapter 7 can still keep their car and house if they meet certain criteria.

Keeping Your Car in Chapter 7

To keep your car in Chapter 7, you generally need to meet a few conditions:

- Equity: The amount of equity (the car’s value minus what you owe on it) must be within the limits of your state’s or federal exemptions. Many states have exemption amounts that cover the full value of an average car.

- Secured Debts: You must continue to make payments on your car loan, which is a secured debt. If you fall behind on payments, the lender can pursue repossessions even during bankruptcy.

- Affirmation: You’ll typically need to formally “reaffirm” the debt, meaning you agree to continue paying it.

Keeping Your House in Chapter 7

Keeping your house in Chapter 7 involves similar considerations:

- Equity: Similar to your car, the equity in your home must be covered by the available exemptions. State and federal laws offer homestead exemptions, which protect a certain amount of equity in your primary residence.

- Mortgage Payments: You must be current on your mortgage payments or be able to catch up quickly. If you are behind, the lender can initiate foreclosure proceedings.

- Reaffirmation: You may need to reaffirm your mortgage debt to keep the house.

Understanding Non-Exempt Assets

If you have significant equity in your car or house that exceeds the exemption limits, you might have to give up the asset, and the trustee would sell it to pay creditors. However, many individuals are able to protect their homes and cars entirely through exemptions.

Chapter 13: The Reorganization Plan

Chapter 13 bankruptcy, often called reorganization or wage earner’s plan, allows individuals with regular income to create a plan to repay some or all of their debts over three to five years. This chapter is often a good option for those who want to keep their property but are behind on payments.

Benefits of Chapter 13 for Asset Protection

Chapter 13 offers robust asset protection for your car and house:

- Catching Up on Payments: If you are behind on your mortgage or car loan, Chapter 13 allows you to catch up on those missed payments through your payment plan, preventing foreclosure or repossessions.

- Automatic Stay: The automatic stay that goes into effect when you file bankruptcy immediately stops most collection actions, including attempts to foreclosure on your home or repossess your car.

- Secured Debts: You can continue making regular payments on your secured debts as part of your repayment plan, ensuring you don’t fall further behind.

How Chapter 13 Works for Your Car and House

- Car Loans: You will typically pay the arrearage (missed payments) over the life of the plan, plus the ongoing monthly payments. In some cases, if you have owned the car for a certain period and the loan is older, you might even be able to reduce the principal balance owed to the car’s current market value (“cramdown”).

- Mortgages: You can pay back missed mortgage payments over the plan period, allowing you to avoid foreclosure. Regular ongoing mortgage payments are made separately from the bankruptcy plan.

Chapter 11: For Higher Income and Complex Situations

While less common for individuals, Chapter 11 bankruptcy is a reorganization option primarily for businesses, but can also be used by individuals with substantial debts or complex financial situations. It’s a more involved process, often requiring significant legal and financial expertise, and allows for extensive negotiation with creditors. Individuals can utilize Chapter 11 to protect assets, including their car and house, by proposing a detailed reorganization plan.

Exemptions: Your Shield for Assets

Exemptions are a cornerstone of asset protection in bankruptcy. They are legal provisions that protect certain types and amounts of property from being seized and sold by the bankruptcy trustee. Every state has its own set of exemptions, and some states allow you to choose between state and federal exemptions.

State vs. Federal Exemptions

- State Exemptions: These vary significantly from state to state. Some states have very generous homestead exemptions, allowing you to protect a large amount of equity in your home. Others may have lower limits. If your state allows you to choose between state and federal exemptions, it’s crucial to analyze which set offers you the best protection for your car and house.

- Federal Exemptions: These are a standardized set of exemptions that are available in states that do not have their own exemption laws or that opt to allow filers to use the federal exemptions. The federal homestead exemption, for instance, is often significantly higher than many state exemptions, but it may not cover the full equity in a home in high-cost areas.

Key Exemptions to Consider

- Homestead Exemption: This protects equity in your primary residence.

- Motor Vehicle Exemption: This protects equity in your car or other vehicles.

- Wildcard Exemption: Some states offer a “wildcard” exemption that can be applied to any type of property, including equity in a car or house, if other exemptions are not sufficient.

How Exemptions Work with Secured Debts

Exemptions primarily protect the equity you have in an asset. If you have a car loan or a mortgage, the lender has a secured debt, meaning their loan is backed by the property itself.

- If your equity is less than the exemption amount: You can usually keep the asset by continuing to make your payments. The exemption protects the equity you own outright.

- If your equity exceeds the exemption amount: This is where it gets trickier. In Chapter 7, the trustee might sell the asset, pay you the exempt amount, and use the remaining proceeds to pay creditors. However, many people avoid this scenario by ensuring their equity is within exemption limits or by opting for Chapter 13.

Avoiding Repossessions and Foreclosure

One of the most significant benefits of filing for bankruptcy is the automatic stay, a legal injunction that immediately halts most creditor actions. This includes attempts to repossess your car or initiate foreclosure on your home.

The Power of the Automatic Stay

When you file for bankruptcy, an automatic stay immediately goes into effect. This means that creditors are legally prohibited from:

- Contacting you to collect debts.

- Garnishing your wages.

- Foreclosing on your home.

- Repossessing your car.

- Taking any other action to collect debts outside of the bankruptcy court.

This stay provides crucial breathing room, allowing you time to evaluate your options and work with your attorney to develop a strategy for keeping your property.

What Happens After the Automatic Stay?

The automatic stay is temporary. To permanently keep your car or house after filing bankruptcy, you must address the secured debts associated with them.

- If you are current on payments: You can usually continue making payments and reaffirm the debt in Chapter 7.

- If you are behind on payments:

- In Chapter 7, you might be able to catch up within a short period if the arrearage is small. However, if you cannot, the lender can request the court to lift the stay to proceed with repossessions or foreclosure.

- In Chapter 13, you can incorporate the missed payments into your repayment plan, making them more manageable and preventing repossessions and foreclosure.

Choosing the Right Bankruptcy Chapter

The decision between Chapter 7 and Chapter 13 is critical for determining your ability to keep your car and house.

Factors to Consider

- Your Income: If your income is below the median income for your state, you likely qualify for Chapter 7. If your income is above the median, you may be required to file Chapter 13.

- Amount of Debt: If you have a large amount of debt that you cannot repay, Chapter 7 might be more appropriate. If you want to pay back a portion of your debts and keep your assets, Chapter 13 is often the better choice.

- Arrears on Secured Debts: If you are significantly behind on your mortgage or car payments, Chapter 13 offers a structured way to catch up and prevent repossessions or foreclosure.

- Non-Exempt Assets: If you have substantial non-exempt assets, Chapter 7 could lead to their liquidation. Chapter 13 provides better asset protection in such scenarios.

A Comparative Look: Chapter 7 vs. Chapter 13

| Feature | Chapter 7 | Chapter 13 |

|---|---|---|

| Primary Goal | Liquidation of non-exempt assets | Reorganization of debts via repayment plan |

| Timeframe | Typically 4-6 months | 3-5 years |

| Keeping Assets | Possible if equity is within exemptions | More structured way to catch up on payments |

| Arrears Management | Difficult to catch up; may risk loss | Can incorporate arrears into payment plan |

| Credit Impact | Significant, remains for 10 years | Significant, remains for 7 years after discharge |

| Suitability | Lower income, minimal non-exempt assets | Regular income, behind on secured debts |

Working with a Bankruptcy Attorney

The bankruptcy process is intricate, with specific rules and deadlines that must be followed. The laws surrounding exemptions, secured debts, and the different chapters of bankruptcy are complex. This is where the expertise of a bankruptcy attorney becomes invaluable.

Why a Bankruptcy Attorney is Essential

- Navigating Exemptions: An experienced attorney can help you identify the best exemption strategy for your situation, maximizing your asset protection and ensuring you don’t inadvertently lose property.

- Choosing the Right Chapter: They can assess your financial circumstances, income, and debts to guide you toward the most beneficial bankruptcy chapter (Chapter 7, Chapter 13, or even Chapter 11 for certain individuals).

- Dealing with Creditors: A bankruptcy attorney will handle communications with creditors, protecting you from harassment and ensuring all actions are taken legally.

- Protecting Your Car and House: They have the knowledge to implement strategies that allow you to keep your car and house, whether by reaffirming debts, developing a Chapter 13 plan to catch up on payments, or utilizing exemptions effectively.

- Avoiding Pitfalls: Mistakes in a bankruptcy filing can lead to dismissal of your case or loss of assets. An attorney helps you avoid these costly errors.

- Negotiating with Lenders: In some cases, a bankruptcy attorney may be able to negotiate with lenders to modify loan terms as part of the bankruptcy process, further aiding in asset protection.

A good bankruptcy attorney will review your entire financial picture, explain your options clearly, and guide you through every step of the process, from filing the initial paperwork to navigating the court proceedings and creditor meetings. They are your primary resource for achieving effective debt relief while safeguarding your essential assets.

Frequently Asked Questions (FAQ)

Can I keep my car if I owe more than it’s worth?

Yes, you can often keep your car even if you owe more than it’s worth, especially in Chapter 13 bankruptcy. In Chapter 7, if the loan balance exceeds the car’s value (negative equity), it’s generally not a concern for the trustee, and you can continue making payments if you wish.

What if I am behind on my mortgage payments when I file for bankruptcy?

If you are behind on your mortgage, Chapter 13 bankruptcy is typically the best option to save your home. It allows you to catch up on the missed payments over a period of three to five years as part of your repayment plan, preventing foreclosure. In Chapter 7, you may be able to catch up if the arrears are small and you can afford to do so quickly, but it’s much riskier.

Can I still file for bankruptcy if my car was repossessed before I filed?

If your car was repossessed before you filed for bankruptcy, it is generally too late to get it back through the bankruptcy process itself. However, some Chapter 13 plans might allow you to purchase a replacement vehicle if it’s deemed necessary for your transportation to work. It’s crucial to speak with a bankruptcy attorney immediately if you anticipate repossessions.

Will bankruptcy affect my ability to buy a car or house in the future?

Yes, filing for bankruptcy will impact your credit score, making it more challenging to obtain loans for a car or house immediately after discharge. However, rebuilding your credit is possible over time. Many people are able to finance a car or mortgage within a few years of completing their bankruptcy.

What are “secured debts” in bankruptcy?

Secured debts are loans where the borrower has pledged specific property as collateral. Common examples include mortgages (collateral is the house) and car loans (collateral is the car). If you fail to pay a secured debt, the lender has the legal right to seize the collateral.

Can I discharge a car loan in bankruptcy?

You generally cannot discharge a secured debt like a car loan in Chapter 7 if you want to keep the car. You must either continue making payments and reaffirm the debt or surrender the car. In Chapter 13, you can pay off the loan through the plan.

What is “debt relief”?

Debt relief refers to the process of reducing or eliminating overwhelming debt. Bankruptcy is a form of legal debt relief, but other methods include debt consolidation, debt settlement, and credit counseling. Bankruptcy offers a comprehensive legal framework for managing and discharging certain types of debt.

Conclusion

The prospect of filing for bankruptcy can seem daunting, but it is a powerful tool for achieving financial freedom and a fresh start. For many individuals, the ability to keep their car and house is paramount. By carefully considering your options, understanding the role of exemptions, and securing the guidance of a qualified bankruptcy attorney, you can navigate the complexities of Chapter 7, Chapter 13, and other bankruptcy avenues to protect your most cherished assets and overcome your financial challenges. The key is proactive planning and informed decision-making to ensure you achieve the best possible outcome for your unique situation, securing the debt relief you need without sacrificing essential property.