Can you trade in a car with negative equity? Yes, you can trade in a car even if you owe more than it’s worth, also known as having negative equity. However, it’s not as simple as a standard trade-in, and it requires careful planning and understanding of your options. This guide will break down how to navigate this often-tricky situation and explore various strategies to help you get out of an underwater car loan.

Image Source: www.fairlease.org

Deciphering Negative Equity

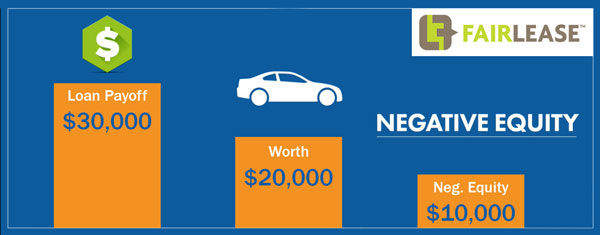

Before we dive into solutions, let’s clarify what negative equity means. You have negative equity when the amount you owe on your car loan is more than the current market value of your vehicle. This is a common predicament, especially if you bought a new car that depreciated quickly or if you financed a large portion of the purchase price with a long loan term.

Key reasons for negative equity:

- Rapid Depreciation: New cars lose a significant portion of their value the moment they are driven off the lot.

- Long Loan Terms: Opting for a 72-month or 84-month loan means you’re paying more interest over time, and your loan balance may decrease slower than the car’s value.

- High Financing Percentage: If you financed 100% of the car’s value or more (including taxes, fees, and add-ons), you likely started with negative equity.

- Market Fluctuations: Sometimes, economic factors or changes in demand can reduce the resale value of certain vehicle models.

Your Options When Facing a Car Trade-in Negative Balance

When you’re looking to trade in your car with a negative balance, you have several paths you can explore. Each comes with its own set of pros and cons.

Option 1: Selling the Car Yourself

One of the most straightforward ways to potentially mitigate negative equity is by selling your car privately.

Benefits of Private Sales:

- Higher Potential Price: You can often get more money selling directly to another individual than trading it in at a dealership.

- Control Over the Sale: You set the price and negotiate directly with buyers.

Drawbacks of Private Sales:

- More Effort Required: You’ll need to advertise, arrange viewings, handle test drives, and manage the paperwork.

- Potential for Scams: Be cautious of dishonest buyers.

- Dealing with the Loan: You’ll need to coordinate with your lender to pay off the loan upon sale.

Steps for a Private Sale:

- Determine Your Car’s Value: Use resources like Kelley Blue Book (KBB), Edmunds, or NADA Guides to get an accurate estimate of your car’s market value.

- Settle the Loan: Contact your lender to get a payoff quote. This is the exact amount you owe to clear the loan.

- Advertise Effectively: Take high-quality photos and write a detailed description.

- Screen Buyers: Ask questions and be wary of unsolicited offers that seem too good to be true.

- Handle the Transaction: Arrange for the buyer to pay you, and then use those funds (plus any extra from your pocket) to pay off the loan immediately. You’ll then sign over the title.

Option 2: Trading In the Car at a Dealership

Trading in a car with negative equity at a dealership is the most common approach, but it requires negotiation.

How it Works:

The dealership will assess your car’s trade-in value. If this value is less than your outstanding loan balance, the difference is your negative equity. The dealership can then offer to:

- Pay Off the Difference: This is rare, but some dealerships might absorb a small amount of negative equity to secure your sale of a new car.

- Roll the Negative Equity into a New Loan: This is the most frequent scenario. The amount you owe on your old car is added to the price of the new car, and you finance the combined amount.

Pros of Dealership Trade-in:

- Convenience: It’s a one-stop shop for selling your old car and buying a new one.

- Simplified Process: The dealership handles most of the paperwork.

Cons of Dealership Trade-in:

- Lower Trade-in Value: Dealerships typically offer less than private sellers.

- Increased Loan Amount: Rolling negative equity into a new loan means you’ll be paying interest on money you didn’t spend on the new car, potentially leading to higher monthly payments and more interest paid over the life of the loan.

Option 3: Paying Off the Negative Equity Out-of-Pocket

If you have the funds available, paying off the difference yourself is often the cleanest way to exit the situation.

How to Do It:

- Get Your Car’s Value: Determine its current market price.

- Calculate the Shortfall: Subtract the car’s value from your outstanding loan balance. This difference is your negative equity.

- Pay the Difference: Use your savings to pay off the loan in full or pay down enough to make the trade-in value equal your loan balance.

Pros:

- No Added Debt: You won’t be carrying over debt into a new loan.

- Avoids Increased Interest: You won’t pay interest on the negative equity.

- Cleaner Transaction: Simplifies the trade-in process.

Cons:

- Requires Available Cash: This option is only feasible if you have the savings.

Option 4: Waiting and Saving

Sometimes, the best strategy for how to handle negative car equity is patience.

Strategy:

- Continue Making Payments: Keep paying down your current car loan.

- Save for a Down Payment: Build up savings for your next vehicle.

- Watch the Market: As your loan balance decreases and your car’s value potentially stabilizes or increases slightly (though unlikely for most vehicles), the gap will narrow.

Pros:

- Reduces Future Debt: You start your next car purchase on stronger footing.

- Avoids Negative Equity: By the time you’re ready to trade, you might have positive equity.

Cons:

- Takes Time: This is a long-term solution.

- Continued Depreciation: Your car will likely continue to depreciate, so time is of the essence.

Strategies for Negotiating Trade-in with Negative Equity

When you’re ready to negotiate a trade-in with a negative balance, having a solid strategy is crucial.

Strategy 1: Get Pre-Approved for Financing

Before you even step into a dealership, get pre-approved for a car loan from your bank or credit union. This gives you a benchmark for interest rates and loan terms.

- Know Your Budget: Pre-approval tells you how much you can realistically borrow.

- Negotiating Power: You can compare the dealership’s financing offer to your pre-approval. If the dealership’s offer is significantly worse, you know to push back.

Strategy 2: Research Your Current Car’s Value Thoroughly

Arm yourself with data from multiple sources. Don’t rely on just one estimate.

- Multiple Valuation Tools: KBB, Edmunds, NADA Guides, and even looking at similar cars for sale locally can give you a comprehensive picture.

- Condition Matters: Be honest about your car’s condition. Dents, scratches, mechanical issues, and high mileage will all reduce its value.

Strategy 3: Separate the Trade-in Negotiation from the New Car Purchase

Dealers often bundle everything together, making it hard to track where your money is going.

- Negotiate the New Car Price First: Get the best possible price for the car you want to buy.

- Negotiate Your Trade-in Value Second: Once the new car price is set, discuss your trade-in. This prevents the dealer from inflating the trade-in value to offset a higher new car price.

Strategy 4: Be Prepared to Pay Cash for the Difference

If you can afford to pay off the negative equity out-of-pocket, do it.

- Avoids Rolling Over Debt: This is the best way to get out of an underwater car loan without extending your debt.

- Negotiate a Cleaner Deal: By eliminating the negative equity, you simplify the transaction.

Strategy 5: Consider Used Car Lots That Specialize in Difficult Financing

Some independent used car dealerships are more flexible with customers who have less-than-perfect credit or negative equity situations. They might be more willing to work with you on terms.

Strategy 6: Don’t Be Afraid to Walk Away

If the numbers don’t work in your favor and you feel pressured, it’s okay to leave. You can always revisit the dealership later or explore other options.

Buying New Car with Negative Equity: What to Expect

When you’re buying a new car with negative equity, the process involves adding the outstanding balance of your old loan to the price of the new vehicle. This is often referred to as rolling negative equity into a new car.

The Financial Impact of Rolling Negative Equity

- Higher Loan Principal: Your new car loan will be for a larger amount.

- Increased Interest Paid: You’ll pay interest on the negative equity amount over the life of the new loan. This means you end up paying more for your new car than its sticker price.

- Higher Monthly Payments: Generally, a larger loan principal translates to higher monthly payments, unless you extend the loan term significantly.

- Longer Loan Term: To keep monthly payments manageable, dealers might offer longer loan terms (e.g., 84 or 96 months). This further increases the total interest paid.

- Potential for Deeper Negative Equity: If the new car also depreciates quickly, you could find yourself in a negative equity situation again sooner than you think.

Example Table: Impact of Rolling Negative Equity

| Scenario | New Car Price | Trade-in Value | Negative Equity | Loan Amount | Monthly Payment (Est.) | Total Interest Paid (Est.) |

|---|---|---|---|---|---|---|

| No Negative Equity | $30,000 | $10,000 | $0 | $20,000 | $375 (60 mo @ 7%) | $2,500 |

| With Negative Equity | $30,000 | $8,000 | $2,000 | $22,000 | $412 (60 mo @ 7%) | $2,750 |

| With Negative Equity | $30,000 | $8,000 | $2,000 | $22,000 | $350 (72 mo @ 7%) | $3,300 |

Note: These are illustrative figures and actual loan payments and interest can vary based on lender, credit score, and specific loan terms.

It’s vital to carefully calculate the total cost of the loan when rolling over negative equity.

How to Sell a Car With a Loan Negative

Selling a car when you still have a loan on it, especially if you have negative equity, requires careful coordination with your lender.

Steps to Sell a Car with a Loan Negative:

- Get Your Payoff Amount: Contact your lender to get the exact amount needed to pay off your loan. This amount might be slightly higher than your current balance due to accrued interest or potential late fees.

- Determine Your Car’s Value: Research your car’s current market value using reliable sources.

-

Compare Value to Payoff:

- Positive Equity: If your car’s value is higher than the payoff amount, you’ll have cash left over after paying off the loan.

- Negative Equity: If your car’s value is lower than the payoff amount, you’ll need to come up with the difference to pay off the loan.

-

Selling Privately:

- Find a Buyer: Advertise your car and find a buyer who is willing to wait for the paperwork.

- The Transaction: You’ll likely need to bring the buyer with you to your bank or credit union. The buyer pays you, and you immediately use those funds to pay off your loan and get the title released. Then, you sign the title over to the buyer. Alternatively, some buyers might be willing to pay the lender directly if they are comfortable.

- Trading In at a Dealership:

- Negotiate: Discuss the trade-in value and how the negative equity will be handled.

- Dealership Pays Lender: The dealership will typically pay off your old loan directly. They will then roll the negative equity into your new car financing.

Car Loan Negative Equity Options Explained

When faced with car loan negative equity, understanding all your options is key to making the best decision for your financial situation.

Option 1: Pay Off the Difference

As mentioned, if you have the cash, paying off the negative equity amount yourself is the most direct route. This allows you to trade in your car without carrying that debt forward.

Option 2: Refinance Your Existing Loan

If your credit has improved since you took out your original loan, you might be able to refinance.

- Lower Interest Rate: This can reduce your monthly payments and the total interest paid.

- Extend Loan Term: While not ideal, extending the term could lower monthly payments, giving you more time to build positive equity. However, this increases the total interest paid.

- Can Refinance Negative Equity? It is extremely rare for lenders to allow you to refinance negative equity into a new loan on the same car. This option is usually only viable if you can pay off the negative portion of the loan separately.

Option 3: Sell Other Assets

Do you have other assets you could sell to cover the negative equity? This could include:

- A second vehicle.

- Unused electronics or furniture.

- Investments or savings that you can liquidate.

Option 4: Consider a Different Type of Vehicle

Perhaps a brand new car isn’t the right move right now. Consider a gently used car that has already undergone its steepest depreciation. This could make it easier to avoid negative equity in the future.

Getting Out of an Underwater Car Loan

The goal is always to get out from under an underwater car loan. Here’s a summary of effective strategies:

- Aggressively Pay Down the Loan: Make extra payments whenever possible. Even an extra $50 or $100 a month can make a difference in the long run.

- Sell the Car: If you can sell it for more than you owe, even with a small profit, do it. If you have negative equity, sell it privately to maximize your return.

- Use Savings: If you have a healthy savings account, consider using a portion of it to pay down the loan or eliminate the negative equity.

- Lease Instead of Buy (for Future Purchases): While not a solution for an existing loan, leasing can sometimes offer lower monthly payments and the ability to get into a new car every few years without the headache of depreciation and trade-in values. However, leasing means you never own the car and have mileage restrictions.

Frequently Asked Questions (FAQ)

Q1: Will a dealership always let me trade in a car with negative equity?

Yes, most dealerships will allow you to trade in a car with negative equity. However, they will typically roll that negative balance into your new car loan, increasing your overall debt and the total interest you pay.

Q2: Can I get a new car loan if I have negative equity on my current car?

Yes, it’s possible. Many lenders are willing to finance the negative equity as part of a new car loan. However, this will increase your loan amount, potentially leading to higher monthly payments or a longer loan term.

Q3: How much negative equity can I roll into a new car loan?

The amount of negative equity a dealership or lender will allow you to roll into a new car loan can vary. It often depends on the lender’s policies, your creditworthiness, and the overall loan-to-value ratio of the new vehicle. Some lenders may have limits, while others might be more flexible, especially if you have good credit.

Q4: Is it better to sell my car privately or trade it in if I have negative equity?

Generally, selling your car privately will yield a higher price, potentially minimizing your out-of-pocket expense to cover the negative equity. Dealerships offer convenience but typically provide a lower trade-in value. If your negative equity is substantial, the extra effort of a private sale might be worthwhile.

Q5: What happens if I just stop paying for my car and I have negative equity?

If you stop paying for your car and have negative equity, the lender will repossess the vehicle. After selling the car, if the sale price doesn’t cover the outstanding loan balance and repossession costs, you will still owe the lender the remaining difference. This is called a deficiency balance, and it will negatively impact your credit score. It’s always better to address the situation proactively.

Navigating negative equity in a car trade-in can be challenging, but with a clear understanding of your options and a strategic approach, you can successfully manage the situation and move forward with your next vehicle. Remember to do your research, be prepared to negotiate, and always consider the long-term financial implications of your decisions.