Image Source: www.brlogistics.net

Guide: How Much To Ship A Car To Philippines From Usa

Shipping a car from the USA to the Philippines involves many steps and different costs. People often ask, “How much does it cost to ship a car from the USA to the Philippines?” and “How long does it take to ship a car to the Philippines?” There is no single price for everyone. The cost changes a lot based on the car you ship, where you ship it from in the USA, the way you ship it, and the taxes in the Philippines. It can take many weeks, usually from 6 to 10 weeks in total, sometimes more. The “best way to ship car to philippines” often depends on if you want to save money (RoRo) or have more protection (container).

This guide helps you learn about all the parts involved. It talks about the shipping cost, the rules in the Philippines, and the taxes you must pay. Shipping a car is a big job, but you can do it with good planning.

Deciphering the Cost of Shipping

The “usa to philippines car shipping cost” is not just one fee. It is a total of many different charges. Think of it like a puzzle with many pieces. Each piece adds to the final cost. Knowing these parts helps you understand the total “import car cost philippines”.

Here are the main things that change the cost:

- The car you are shipping: Big, heavy cars cost more to ship than small, light cars. This is because they take up more space or weigh more on the ship. The value of your car also affects insurance costs and the taxes you pay in the Philippines.

- Where you ship from in the USA: Shipping from a port close to you costs less than moving the car across the country first. Major ports on the West Coast, like in California, are common places to ship from because they are closer to Asia.

- The way you ship your car: There are two main ways to send a car over the ocean. One way is usually cheaper, but the other offers more safety.

- Ocean shipping rates: These rates change over time. They are like airline tickets; they can go up or down based on fuel costs, the time of year, and how busy the shipping companies are. This affects the “international car shipping rates to philippines”.

- Fees at the ports: Both the port in the USA and the port in the Philippines charge fees. These cover things like moving your car onto and off the ship.

- Insurance: You need insurance in case something happens to your car during the trip. The cost of insurance depends on the value of your car.

- Taxes and Duties in the Philippines: This is often the biggest part of the cost. The Philippine government charges taxes and duties based on the type and value of your car. We will talk more about “customs fees for importing car to philippines” and “car import tax philippines” later.

- Other fees: These can include fees for making documents, cleaning the car before shipping, or using a customs broker in the Philippines.

All these things together make the full cost. It is important to get a clear list of all fees from any shipping company you talk to.

Exploring Shipping Options

You have two main choices for sending your car across the ocean from the USA to the Philippines. The choice you make affects the “international car shipping rates to philippines” and how safe your car is during the trip.

h4: Roll-on/Roll-off (RoRo) Shipping

RoRo is often the cheapest way to ship a car. It is like a big parking garage on a ship.

- How it works: You drive your car onto the ship at the departure port. It stays in a special spot inside the ship during the trip. At the destination port, your car is driven off the ship.

- Good points:

- Usually costs less than other methods.

- Simple process at the port.

- Ships often leave on a regular plan.

- Things to know:

- Your car must be able to be driven.

- You cannot pack personal items inside the car. Customs rules in both the USA and the Philippines are very strict about this.

- Your car is open to the air inside the ship, but it is not outside. Still, it has less protection than being in a box.

- Damage can happen if cars shift or if people are not careful when driving them on and off.

RoRo is a good choice if saving money is your top goal and your car is in good working order.

h4: Container Shipping

Container shipping puts your car inside a large metal box (a container). This box is then put onto a ship.

- How it works: Your car is driven or lifted into a container. The container is sealed. The container is then loaded onto the ship. At the other end, the container is opened, and your car is taken out.

- Good points:

- Offers much more protection from weather and damage.

- Your car is sealed and secure inside the container.

- Sometimes, depending on the shipper and specific rules, you might be allowed to pack some personal items in the trunk or back seat (but check rules very carefully, this is often not allowed or causes customs problems).

- Things to know:

- Costs more than RoRo shipping.

- Can take a little longer because of the steps to load and unload the container.

- You need to get the car to a special facility to be loaded into the container.

There are two ways to use container shipping for a car:

- Shared Container: Your car is put into a container with other cars (or sometimes other goods). You share the cost of the container with the other people. This is cheaper than having your own container. However, you must wait until the container is full before it ships. This can add time to the process. This is part of the “container shipping cost car philippines”.

- Exclusive Container: Your car is the only thing in the container. This is the most expensive way to ship. But it is the fastest container option because you don’t wait for others. It offers the most space and highest level of protection and privacy. This is the full “container shipping cost car philippines” for one car.

Container shipping is often seen as the “best way to ship car to philippines” if protecting your car is more important than the cost. Shared container is a middle ground between RoRo and an exclusive container.

The Journey: Steps to Ship Your Car

Sending your car over the ocean takes careful steps. Here is a simple look at the process.

- Step 1: Get Price Quotes: Ask several shipping companies how much it will cost. Give them details about your car (year, make, model, size) and where you are shipping from and to. This gives you an idea of the “usa to philippines car shipping cost”.

- Step 2: Choose a Shipper: Pick a company you trust. Look at their experience, reviews, and what is included in their price. Do they handle shipping and help with paperwork?

- Step 3: Prepare Your Car: Clean your car well, inside and out. Remove all your personal items. The gas tank should be low (about a quarter full). Note any damage that is already on the car. Take photos. Make sure the car is running well if you use RoRo.

- Step 4: Paperwork: Gather all needed documents. This includes your car title, registration, bill of sale, your ID (passport), and forms from the shipping company. You also need to start the process for getting permission to import the car into the Philippines. This is a very important step related to “philippine regulations for importing cars”.

- Step 5: Drop Off or Pickup: Take your car to the shipping port or facility. Or, the shipping company might pick it up from your home (this costs extra). The company will check the car and note its condition.

- Step 6: The Ocean Trip: Your car is loaded onto the ship. This is the main part of the “how long does it take to ship car to philippines”. The trip across the Pacific Ocean takes many weeks.

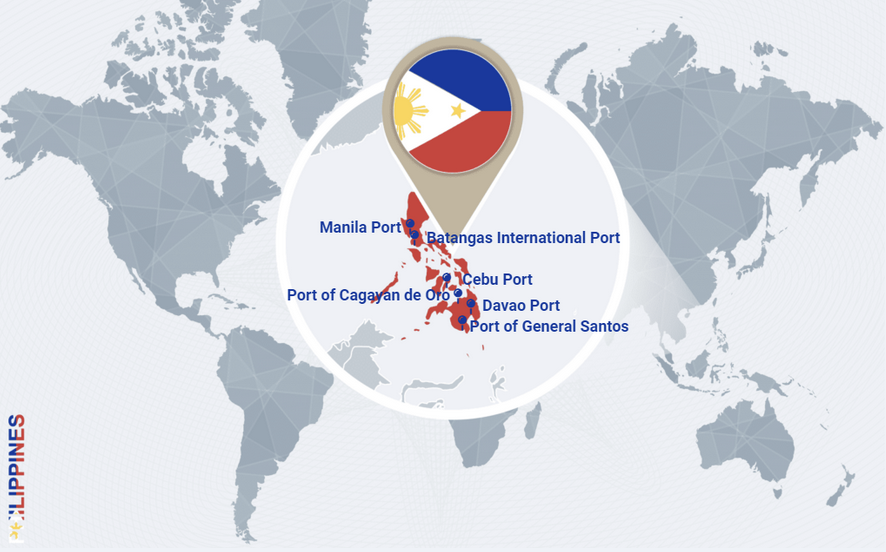

- Step 7: Arrival in the Philippines: The ship arrives at the port, likely in Manila or another major port. Your car is taken off the ship.

- Step 8: Customs Clearance: This is where you or your agent (a customs broker) deal with Philippine Customs. You pay taxes and duties. This is the main part of the “customs fees for importing car to philippines” process. It can take time.

- Step 9: Get Your Car: Once customs clear your car, you can pick it up from the port or facility.

Each step needs careful work. Missing a step or having wrong papers can cause long delays and extra costs.

Navigating Philippine Import Rules

Before you ship a car to the Philippines, you must know the rules. The “philippine regulations for importing cars” are set by the government. They decide which cars you can bring in and what you must do. These rules are meant to control the types and ages of cars entering the country.

Key things about the rules:

- Age Limit: Most of the time, you can only import cars that are not older than ten (10) years from the year they were made. For example, if it is 2024, you can usually only import cars made in 2014 or later. There are some special cases, like for returning residents who have owned the car for a long time, but the main rule is the 10-year limit. This is a very important rule to check before you ship.

- Left-Hand Drive: Cars must be left-hand drive. Cars made for countries that drive on the left side of the road (right-hand drive cars) are usually not allowed.

- Import Authority: You need special permission to import a car. This is called an “Authority to Import” or similar document. You get this from the Philippine Department of Trade and Industry (DTI). You usually need to apply for this before your car arrives.

- Personal Use: The rules are usually easier if you are a returning Filipino resident or immigrant bringing your personal car that you have owned and used abroad for at least one year. Rules are much harder and sometimes not possible for importing cars just to sell them.

- Required Documents: You need many papers. These include:

- Proof that you own the car (like the original title).

- Proof of how much you paid for the car (bill of sale).

- Your passport and visa (if you are not a Filipino).

- Proof you are a returning resident (if that applies).

- The Import Authority from DTI.

- Shipping documents (bill of lading).

- Other forms from Philippine Customs and other government offices.

Getting the Import Authority and having all the right papers in order before the car gets to the Philippines is very important. If your car arrives without the needed permission or documents, it can lead to big storage fees at the port and long delays. It might even mean you cannot import the car at all.

Grasping Import Taxes and Duties

The biggest part of the “import car cost philippines” is often the taxes and duties you pay to the Philippine government. This is known as “customs fees for importing car to philippines” or “car import tax philippines”. These costs are based on the value of your car and its engine size. Figuring out the exact amount beforehand can be hard because Philippine Customs decides the value of your car.

Here are the main taxes and duties:

h4: Customs Duty

- This is a tax on goods brought into the country.

- For cars, it is a percentage of the car’s value.

- Philippine Customs does not always use the price you paid for the car. They have their own way of figuring out the market value of the car when it arrives in the Philippines. This value is called the “dutiable value”.

- They look at things like the car’s age, make, model, and condition. They use a book or system with standard values.

- The duty rate is often around 30% for cars, but this can change based on trade agreements or car type.

h4: Value Added Tax (VAT)

- This is a tax on most goods and services in the Philippines.

- The VAT rate is currently 12%.

- It is charged on the total of the car’s dutiable value plus the Customs Duty plus other costs like shipping and insurance. This means you pay tax on the tax!

h4: Ad Valorem Tax

- This is a tax based on the value of the car and its engine size.

- It is meant to tax larger, more powerful cars more.

- The rates go up as the car’s value and engine size increase. This tax can be very high for expensive cars or cars with big engines.

- The value used here is often the same dutiable value used for Customs Duty.

h4: Documentary Stamp Tax (DST)

- A small tax on documents, including import documents.

h4: Other Potential Fees at the Port

- Arrastre Charges: Fees for moving the car from the ship to the port storage area.

- Storage Fees: If you do not clear your car quickly, the port will charge you for storing it. These fees add up fast.

- Demurrage: Fees charged by the shipping line if you do not pick up the container (if using container shipping) from the port within a set time.

- Customs Broker Fee: Most people hire a licensed customs broker in the Philippines to handle the clearance process. This is highly recommended because the rules are complex. Their fee is an added cost.

Putting it Together: An Example (Rough Guess!)

Let’s say Philippine Customs values your car at $10,000. Shipping and insurance cost $2,000.

- Dutiable Value: $10,000

- Customs Duty (30%): $10,000 * 0.30 = $3,000

- Value for VAT: $10,000 (Value) + $3,000 (Duty) + $2,000 (Shipping/Insurance) = $15,000

- VAT (12%): $15,000 * 0.12 = $1,800

- Ad Valorem Tax: This depends on the engine size and value. It could be anywhere from a few hundred dollars to several thousand dollars, or even more for luxury cars. Let’s guess a moderate $2,000 for this example.

- DST: Maybe $50

- Port Fees & Broker: Maybe $500 – $1000+

Estimated Total Taxes & Fees (Example): $3,000 + $1,800 + $2,000 + $50 + $750 (average of port/broker) = $7,600

Add this to the shipping cost ($2,000 in this example). The total could be around $9,600.

IMPORTANT: This is just a very rough example. The actual taxes and fees can be much higher, easily going over the car’s value itself, especially for newer or more expensive cars. Getting a solid estimate on taxes from a Philippine customs broker is vital before you ship. They are the experts on “customs fees for importing car to philippines” and “car import tax philippines”.

h5: Table of Possible Costs

Here is a table showing the types of costs you might face.

| Cost Type | Who Charges It? | When Is It Paid? | Notes |

|---|---|---|---|

| Shipping Fee | Shipping Company | Before shipping | Varies by car, method (RoRo/Container), and distance. |

| Insurance | Shipping Company/Insurer | Before shipping | Based on car value. |

| Port Fees (USA) | USA Port | Before shipping | For handling the car at the departure port. |

| Ocean Freight | Shipping Company | Before shipping | Cost to move the car across the sea. Part of Shipping Fee. |

| Port Fees (Philippines) | Philippine Port Authority | After arrival | Arrastre, wharfage for handling at arrival port. |

| Customs Duty | Philippine Customs | During customs clearance | Percentage of car’s dutiable value (set by Customs). |

| Value Added Tax (VAT) | Philippine Customs | During customs clearance | 12% on total cost (value + duty + shipping + insurance). |

| Ad Valorem Tax | Philippine Customs | During customs clearance | Tax based on value and engine size. Can be high. |

| Documentary Stamp Tax | Philippine Customs | During customs clearance | Small tax on import documents. |

| Storage Fees | Philippine Port/Warehouse | After arrival (if delayed) | Charges for keeping car if not cleared quickly. Can be expensive. |

| Demurrage | Shipping Line | After arrival (if delayed) | Fee for not picking up container on time (Container shipping). |

| Customs Broker Fee | Philippine Customs Broker | During customs clearance | Payment for the agent handling customs paperwork. Highly recommended. |

| Other Fees | Various | Various | Cleaning, inspection, delivery to final location, etc. |

This table helps break down where the “import car cost philippines” comes from. The Philippine government taxes and fees often cost more than the shipping itself.

How Long Does the Whole Thing Take?

People always want to know “how long does it take to ship car to philippines”. The answer is that it takes many weeks. It is not a fast process. You need to be patient.

Here is a simple look at the timeline:

- Getting Ready (USA Side): Finding a shipper, getting quotes, preparing your car, doing the initial paperwork. This can take from 1 to 2 weeks. Sometimes longer if you need to move the car far to the port.

- Waiting for the Ship: Depending on the shipping method (especially shared container) and the ship schedule, there might be waiting time before your car is loaded. This varies a lot, maybe a few days to 1 or 2 weeks.

- Ocean Trip (USA to Philippines): This is the longest part. A ship traveling across the Pacific Ocean from the West Coast of the USA to the Philippines takes time. The actual sea travel is usually around 4 to 6 weeks. Weather or port stops can add time.

- Arrival and Port Handling: Once the ship arrives, it takes time to unload the cars. This might take a few days.

- Customs Clearance (Philippines Side): This is often the most unpredictable part of the “how long does it take to ship car to philippines”. If all your papers are perfect and Customs is not busy, it might take 1 to 2 weeks. But if there are any issues with documents, car valuation, or if the port is very busy, it can easily take 3 weeks or much longer. Hiring a good customs broker can help speed this up.

Total Estimated Time:

Adding these times up: 1-2 weeks (Prep) + 0-2 weeks (Waiting) + 4-6 weeks (Sea Travel) + 1-3+ weeks (Customs).

This gives a total time that is often 6 to 10 weeks or more.

Factors that can cause delays:

- Bad weather at sea or at the ports.

- Port congestion (too many ships at once).

- Incomplete or incorrect paperwork.

- Issues during the customs inspection or car valuation.

- Holidays in either the USA or the Philippines.

- Delays by the shipping company.

It is wise to expect delays and plan for your car to arrive later than the first estimate. Do not make important plans that depend on having your car available by a certain date.

Specifics: Shipping from California

Many people shipping a vehicle from the USA to the Philippines send it from California. This is because California has big ports on the West Coast, like Los Angeles, Long Beach, and Oakland. These ports have regular ship routes going across the Pacific to Asia.

Shipping a vehicle from california to philippines might have some small advantages:

- More Shipping Options: Ports like LA/Long Beach are major international hubs. You might find more shipping companies serving this route, which could give you more choices for timing or price.

- Shorter Inland Travel (if you are in California): If you live in or near California, you save the cost and time of moving your car across the USA to the East Coast or Gulf Coast ports. This reduces the first part of the “usa to philippines car shipping cost”.

- Possibly Shorter Sea Time: West Coast ports are closer to the Philippines than East Coast ports. This can sometimes mean a slightly shorter ocean journey, though the difference might only be a few days.

However, the basic process, the fees at the Philippine end (“customs fees for importing car to philippines”, “car import tax philippines”), and the Philippine import rules (“philippine regulations for importing cars”) are the same no matter which USA port you ship from. The main difference when “shipping a vehicle from california to philippines” is often just the first leg of the journey and maybe slightly better access to different shipping schedules.

Picking Your Shipper

Choosing the right company to ship your car is a big step. A good shipper makes the process smoother. A bad one can cause stress and unexpected costs.

Here is what to look for:

- Experience with Philippines: Choose a company that has shipped cars to the Philippines before. They will know the ports, the routes, and maybe even have contacts to help with the process.

- Licensing and Bond: Make sure the company is properly licensed and bonded in the USA. This protects you if something goes wrong. You can check with the Federal Maritime Commission (FMC).

- Insurance: Ask about their insurance options. What does it cover? How much does it cost? Is it based on the car’s value? Get enough insurance to cover your car in case of damage or loss.

- Clear Pricing: Get a detailed quote that lists all the costs included. Ask about costs that are not included, especially fees at the destination port and taxes. Make sure they explain the “usa to philippines car shipping cost” fully.

- Communication: How easy is it to talk to them? Do they answer your questions clearly and quickly? You need a company that keeps you updated.

- Reviews and Reputation: Look for reviews from other customers. What do people say about their experience?

Do not just pick the cheapest option. Compare services, insurance, and how helpful the company seems. A slightly higher price for a reliable shipper can save you many problems later. Ask about their experience with both RoRo and “container shipping cost car philippines” if you are considering both.

Summing Up the Costs

So, how much does it cost in total? As we said, there is no one number. But we can give a rough idea based on the parts.

The total “import car cost philippines” includes:

- Shipping Cost: This is the fee to get the car from the USA port to the Philippines port. This includes ocean freight, port fees in the USA, and maybe inland transport if needed. This part can range from about $2,000 to $4,000+, depending on car size, method (RoRo vs. Container), and origin point like “shipping a vehicle from california to philippines”.

- Insurance: Usually a percentage of the car’s value, maybe 1% to 2%.

- Philippine Government Taxes & Duties: This is the Customs Duty, VAT, Ad Valorem Tax, and DST. This is the hardest part to guess exactly. It can be anywhere from about 40% to over 100% of the car’s value (as determined by Philippine Customs!). For a car valued at $10,000, the taxes alone could be $4,000, $8,000, or even much more, especially with high Ad Valorem Tax on certain vehicles.

- Philippine Port Fees & Local Costs: Arrastre, storage (if delayed), customs broker fees, delivery from port. This could be another $500 to $2,000+.

Adding it all up, the total cost to ship a car from the USA and get it cleared in the Philippines often falls into a range of $5,000 to $15,000 or more. This range is very wide because the Philippine taxes depend so much on the specific car and how Customs values it. The most important thing to get a good handle on is the potential “car import tax philippines”.

h5: Key Cost Takeaway

The shipping cost across the ocean is a big part, but the taxes and fees charged by the Philippine government are usually the largest part of the total expense. You must factor in these taxes when deciding if shipping your car is worth it.

Is It Worth It?

For many people, especially returning residents who have owned their car for a long time, shipping a familiar and reliable car might be worth the cost and effort. It can be cheaper than buying a similar car in the Philippines, where cars can be expensive due to import taxes.

However, if your car is old, low in value, or you only plan to be in the Philippines for a short time, the total cost (shipping + taxes) might be more than the car is worth or more than buying a car locally. It is wise to compare the total cost of shipping to the cost of buying a car in the Philippines.

Doing your homework on “philippine regulations for importing cars” and getting clear estimates on the “customs fees for importing car to philippines” are key steps in deciding if shipping is the right choice for you.

Frequently Asked Questions

h4: Can I ship any car to the Philippines from the USA?

No, not usually. There is an age limit. Most cars imported for personal use must be no older than 10 years from their manufacturing date. There are also rules about the steering wheel being on the left side.

h4: How accurate are the shipping quotes I get?

Initial quotes are estimates. They should cover the shipping and USA port fees. However, they often do not include the Philippine taxes, duties, port fees, or customs broker fees. These destination costs are often the most variable and highest part. Always ask what is not included in the quote.

h4: Can I pack personal items inside the car when shipping?

Usually, no. Customs rules in both the USA and the Philippines are very strict about this. If you ship via RoRo, you cannot pack anything. If you use container shipping, some companies might allow items, but it is risky and can cause major problems and delays with Philippine Customs, leading to extra fees or even rejection of the import. It is safest to ship only the car.

h4: Do I need to hire a customs broker in the Philippines?

Yes, it is highly recommended. The process of clearing a car through Philippine Customs is complex. A good customs broker knows the rules, the needed documents, and how to work with Customs to get your car released. Their fee is worth it to avoid costly mistakes and delays.

h4: What happens if my car arrives without the right papers?

Your car will likely be held at the port. You will have to pay daily storage fees, which can add up quickly. You will also need to fix the paperwork issues, which can cause long delays. In some cases, you might not be allowed to import the car at all.

h4: How is the value of my car for tax decided in the Philippines?

Philippine Customs determines the “dutiable value” of your car. They use their own guide or system based on the car’s make, model, year, and condition, not always the price you paid. This value is used to calculate the Customs Duty, VAT, and Ad Valorem Tax. This is a key part of the “car import tax philippines”.

h4: What documents are most important?

Key documents include the original car title, a bill of sale (proof of purchase), your passport and proof of residency status, the Bill of Lading from the shipping company, and the required Import Authority from the Philippine Department of Trade and Industry (DTI).

Shipping a car from the USA to the Philippines is a detailed and costly process. Knowing the steps, the rules, and the likely costs helps you plan well. Getting quotes and understanding the taxes are your most important first steps.