Yes, you can generally purchase a car while in Chapter 13 bankruptcy, but it’s not as simple as walking onto a car lot. There are specific rules and procedures you must follow to ensure your Chapter 13 car purchase is approved and doesn’t jeopardize your bankruptcy case. This guide will delve into the intricacies of buying a car Chapter 13, covering everything from initial considerations to the actual Chapter 13 vehicle acquisition.

Image Source: www.stoneroselaw.com

Navigating the Road to a New Car in Chapter 13

Chapter 13 bankruptcy, also known as a wage earner’s plan, is a repayment plan designed to help individuals with regular income catch up on their past-due bills and repay a portion of their debts over three to five years. During this time, your finances are under the supervision of a bankruptcy trustee, and significant financial decisions, like purchasing a car, require careful planning and court approval.

Why You Might Need a Car During Chapter 13

Life doesn’t stop just because you’re in bankruptcy. Many filers need a reliable vehicle for essential purposes:

- Commuting to Work: A car is often crucial for maintaining employment, which is necessary to fund your Chapter 13 repayment plan.

- Medical Appointments: Access to healthcare is vital, and a car can be essential for getting to doctors’ offices and therapy sessions.

- Daily Errands: Groceries, childcare, and other necessities require transportation.

- Vehicle Replacement: If your current vehicle is old, unreliable, or about to break down, replacing it becomes a necessity.

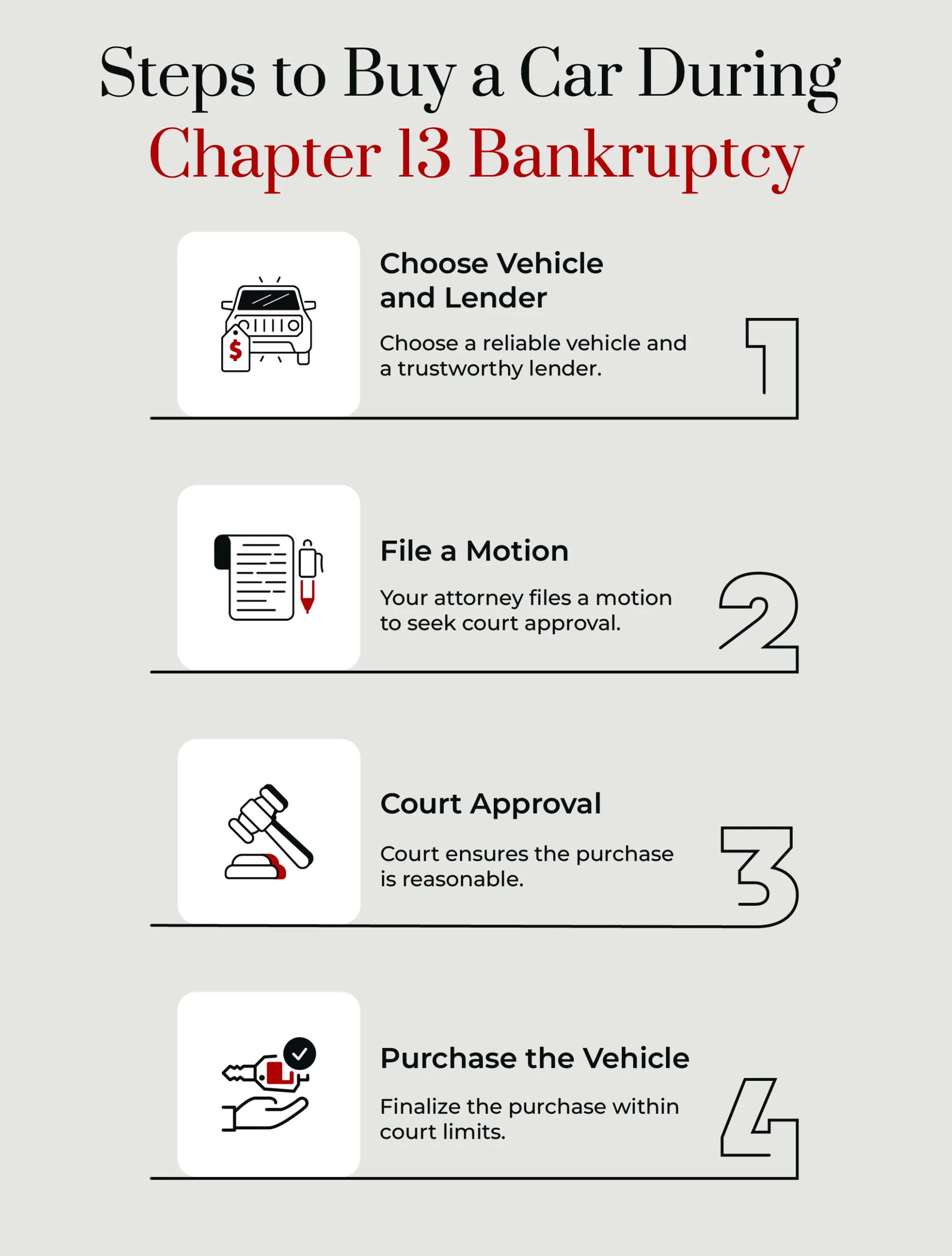

The Process of Chapter 13 Vehicle Acquisition

Obtaining a car in Chapter 13 involves more than just picking a model. You’ll need to demonstrate to the court and your trustee that the purchase is necessary and affordable.

Step 1: Consulting Your Bankruptcy Attorney

Your first and most important step is to discuss your need for a car with your bankruptcy attorney. They are your guide through this complex process and will advise you on the best course of action based on your specific case. They can help you understand the car purchase rules Chapter 13 and what documentation will be required.

Step 2: Demonstrating Necessity

You’ll need to prove to the court that the car purchase is a necessity, not a luxury. This usually involves showing:

- Your current vehicle is unreliable or unusable. This could be due to mechanical failure, extensive repair costs exceeding its value, or it being declared a total loss.

- Lack of viable alternatives. You may need to demonstrate that public transportation, carpooling, or other options are not feasible for your situation.

- The car is essential for your ability to earn income. This is often the strongest argument for needing a vehicle.

Step 3: Trustee Approval and Court Motion

In most Chapter 13 cases, you cannot buy a car without first filing a “Motion for Authority to Incur Debt” or a similar motion with the bankruptcy court. This motion formally asks the court for permission to buy a car and take on a new loan.

- The Chapter 13 Trustee’s Role: The trustee will review your motion. They typically want to see that the car is necessary, that you’ve secured reasonable financing, and that the payments won’t unduly burden your Chapter 13 plan. The trustee might object if they believe the purchase is unnecessary or the terms are unfavorable.

- Court Approval: If the trustee does not object, or if they approve the motion, the judge will typically grant it. If there’s an objection, a hearing may be scheduled where you, through your attorney, will have to present your case for the purchase.

Step 4: Securing Chapter 13 Auto Financing

Getting a Chapter 13 car loan can be challenging, as lenders may view bankruptcy filers as higher risk. However, it’s not impossible.

Options for Chapter 13 Auto Financing

- “Buy Here, Pay Here” Dealerships: Some car dealerships Chapter 13 specialize in working with individuals in bankruptcy. They may offer in-house financing, but be aware that interest rates can be very high.

- Credit Unions and Banks: Some financial institutions have specific programs for those in bankruptcy, especially if you have a good relationship with them prior to filing.

- Secured Loans: You might be able to get a secured loan, where the car itself serves as collateral.

- Pre-Approved Car Loan Chapter 13: It’s highly recommended to try and get pre-approved for a loan before you go to a dealership. This gives you leverage and shows the court you’ve done your homework and secured reasonable financing. Your attorney can often help you find lenders who are open to financing Chapter 13 filers.

What Lenders Look For

When evaluating your application for a Chapter 13 auto financing, lenders will consider:

- Your credit score (pre- and post-bankruptcy, if applicable).

- Your income and employment stability.

- The terms of your Chapter 13 plan.

- The necessity of the vehicle.

- The overall debt-to-income ratio.

Step 5: Choosing the Right Vehicle

The type of car you can purchase is also subject to scrutiny. Courts and trustees generally expect you to choose a reasonable and necessary vehicle.

- Focus on Reliability and Affordability: A modest, reliable sedan or compact SUV is usually a better choice than a luxury vehicle or a sports car.

- Avoid Excessive Costs: You’ll need to justify the price of the vehicle. If you’re looking at a car that is significantly more expensive than what’s considered “standard” for transportation needs, you may face difficulties getting approval.

- Consider the Impact on Your Plan: The monthly car payment, including insurance and maintenance, must fit within your budget and your Chapter 13 plan.

Key Considerations for a Bankruptcy Car Purchase

When you’re contemplating buying a car Chapter 13, keep these crucial points in mind:

The Value of the Vehicle

Bankruptcy courts often scrutinize the value of the vehicle you wish to purchase. There isn’t a fixed dollar amount that applies to every case, as it depends on your income, your debts, and your local court’s rules. However, a general guideline is that the vehicle should be:

- Necessary for essential transportation.

- Priced reasonably for its purpose.

- Not an extravagant purchase.

Your attorney can provide insights into what is typically considered acceptable in your jurisdiction. The Chapter 13 trustee car review will focus on whether the vehicle meets these criteria.

Loan Terms and Interest Rates

Securing favorable loan terms is paramount when obtaining a Chapter 13 car loan. High interest rates can significantly strain your budget and potentially lead to a motion to dismiss your Chapter 13 case if you can’t meet your obligations.

- Interest Rate Caps: While not always mandated, judges may look for interest rates that are not excessively high.

- Loan Term: Shorter loan terms are generally preferred. A loan term that extends beyond your Chapter 13 plan completion can be problematic.

- Down Payment: A substantial down payment can strengthen your motion and demonstrate your commitment.

Impact on Your Chapter 13 Plan

Every new debt you take on will affect your Chapter 13 repayment plan.

- Disposable Income: The car payment must be manageable within your disposable income after covering your essential living expenses and your Chapter 13 plan payments to creditors.

- Budget Adjustments: You may need to adjust your budget to accommodate the new car payment. This might involve cutting back on other discretionary spending.

- Trustee Scrutiny: The Chapter 13 trustee will carefully examine your budget to ensure the car purchase doesn’t prevent you from making your required plan payments.

Alternatives to Buying a Car in Chapter 13

If purchasing a car seems too challenging, consider these alternatives:

- Repairing Your Current Vehicle: If your current car is fixable, investing in repairs might be a more viable option, provided the cost is reasonable.

- Leasing (with caution): While leasing involves ongoing payments, it can sometimes be an option if your attorney advises it and you can demonstrate affordability. However, this is often more complex in bankruptcy.

- Utilizing Public Transportation or Rideshares: If feasible, these can be temporary solutions until you are in a stronger financial position.

- Borrowing from Family or Friends: If you have supportive family or friends, borrowing money for a car might be an option, but ensure clear repayment terms are established.

Common Pitfalls to Avoid

When attempting a bankruptcy car purchase, be aware of potential pitfalls:

- Buying a Car Without Court Approval: This is a critical error. Proceeding without a court order can lead to serious consequences, including the dismissal of your Chapter 13 case.

- Purchasing an Unnecessary or Luxury Vehicle: The court will question the necessity of a high-end vehicle.

- Securing Unfavorable Loan Terms: High interest rates or unmanageable payment terms can derail your repayment plan.

- Not Disclosing the Purchase: Always be transparent with your attorney and the trustee about any significant financial transactions.

Frequently Asked Questions (FAQ)

Q1: Can I get a loan for a car while in Chapter 13?

A1: Yes, you can generally get a loan for a car while in Chapter 13, but you must obtain court approval first.

Q2: Do I need permission from the court to buy a car in Chapter 13?

A2: Yes, you absolutely need to file a motion with the bankruptcy court requesting permission to purchase a car and incur new debt.

Q3: Can I buy a car from any dealership when in Chapter 13?

A3: While you can technically visit any dealership, you will still need court approval for the purchase and financing. Some car dealerships Chapter 13 specialize in assisting individuals in bankruptcy.

Q4: What kind of car can I buy in Chapter 13?

A4: You should focus on purchasing a reliable and affordable vehicle that is necessary for your transportation needs. Luxury vehicles are generally not approved.

Q5: What is a pre-approved car loan chapter 13?

A5: A pre-approved car loan Chapter 13 means you’ve received conditional approval from a lender for a car loan before you file your motion with the court. This can strengthen your case for approval.

Q6: How does the Chapter 13 trustee view car purchases?

A6: The Chapter 13 trustee reviews your request to ensure the car is a necessity, the financing is reasonable, and the payments won’t jeopardize your ability to complete your Chapter 13 plan.

Q7: What are the car purchase rules Chapter 13?

A7: The primary rules involve demonstrating necessity, obtaining court and trustee approval, and securing reasonable financing that fits within your Chapter 13 budget.

Q8: Can I get a Chapter 13 car loan if I have bad credit?

A8: It can be more challenging, but not impossible. You may need to look at specialized lenders or “buy here, pay here” dealerships, but always be wary of excessively high interest rates.

Q9: What happens if I buy a car without court approval?

A9: Buying a car without court approval can lead to severe consequences, including the dismissal of your Chapter 13 case, which would force you to return any vehicle purchased.

Q10: Is there a limit on the price of the car I can buy in Chapter 13?

A10: While there isn’t a specific dollar limit, the car’s price must be reasonable and justifiable as a necessity. Your attorney can guide you on what is typically considered acceptable.

Conclusion: A Well-Planned Journey

Buying a car while in Chapter 13 bankruptcy is a process that requires diligence, transparency, and the guidance of an experienced bankruptcy attorney. By demonstrating necessity, securing appropriate financing, and adhering to court procedures, you can successfully navigate the requirements for Chapter 13 vehicle acquisition and get back on the road with a reliable vehicle. Remember, the goal of Chapter 13 is to help you regain financial stability, and obtaining essential transportation can be a vital part of that journey when done correctly.